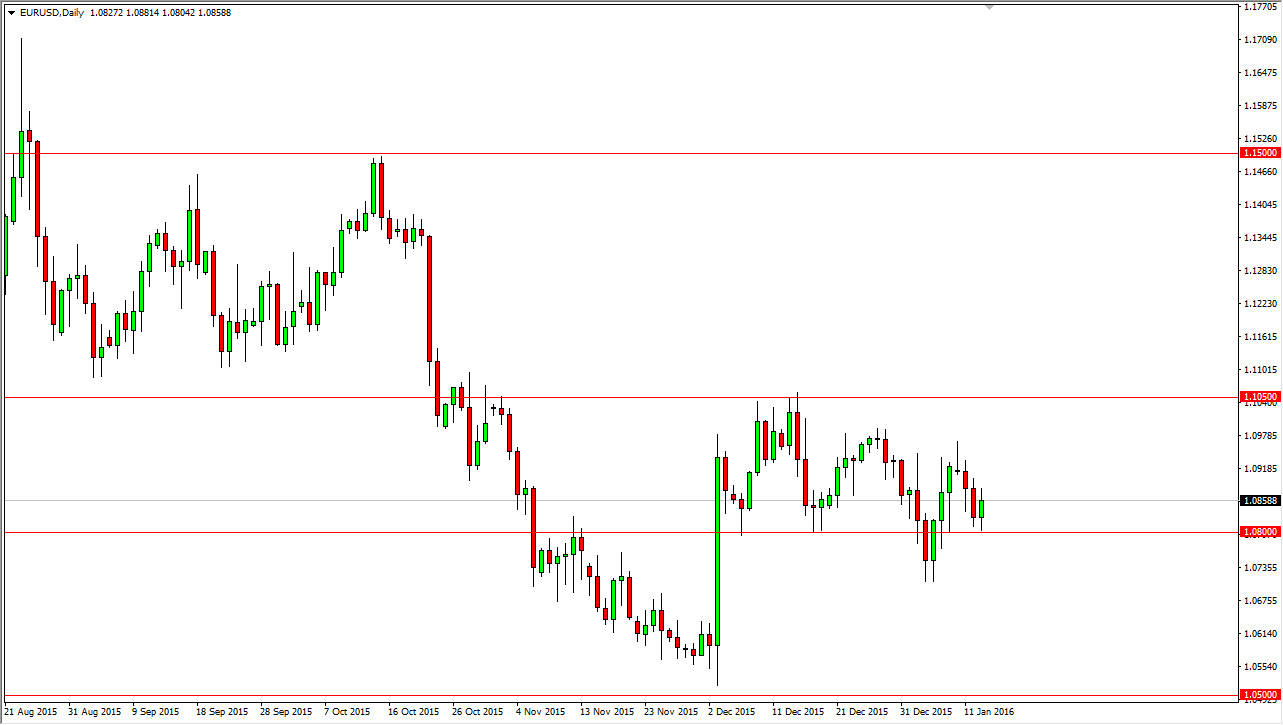

EUR/USD

The EUR/USD pair initially fell during the day on Wednesday, but found enough support at the 1.08 level to turn things around and form a slightly positive candle. At the end of the day though, it wasn’t very impressive as we gave back some of our gains, and as a result the market still looks quite a bit like one that is indecisive. With this being the case, I don’t really like trading this particular pair because I have support at the 1.08 level, but also recognize that this market has been slightly slumping during the course of the last several weeks, so although it’s been very choppy, we have had a bit of a downward tilt.

With all that being said, I’m actually sitting on the sidelines but I recognize that it is probably going to be easier to simply sell this pair on short-term rallies for short-term trades. I do not see a situation here where I would be willing to take a longer-term trade.

GBP/USD

The GBP/USD pair fell significantly during the day on Wednesday, but turned back around to form a bit of a hammer. The hammer of course is a very bullish sign, and we did form one on Tuesday as well. With that being said, I recognize that there is a lot of resistance above so any rally at this point in time should invite sellers, which of course will have me selling as well. I believe that a break down below the bottom of the range for the Tuesday session is also reason to continue selling, as it would show quite a bit of momentum picking up to the downside.

I don’t really have a scenario in which I’m buying this pair at the moment, and I believe that it is only a matter of time before the sellers return anytime this market moves. We do have an interest rate announcement coming out of England today, so we could get a short-term burst higher, but that should just simply offer value in the us dollar.