EUR/USD

The EUR/USD pair fell during the day on Tuesday, as we continue to try to drive down to the 1.08 handle. This is an area that was supportive in the past, and as a result could be in the future. However, we have also dropped down to the 1.07 level recently, and I believe that eventually that is where we are heading. We are forming a little bit of a downward channel at this point in time, so this would be a simple continuation of that move.

The US dollar is gaining strength worldwide, and of course the Euro is not going to be any different. I think that short-term rally should be selling opportunities, but quite frankly I am not looking for any real significant move anytime soon as this market continues to be very choppy with all of the indecision out there.

GBP/USD

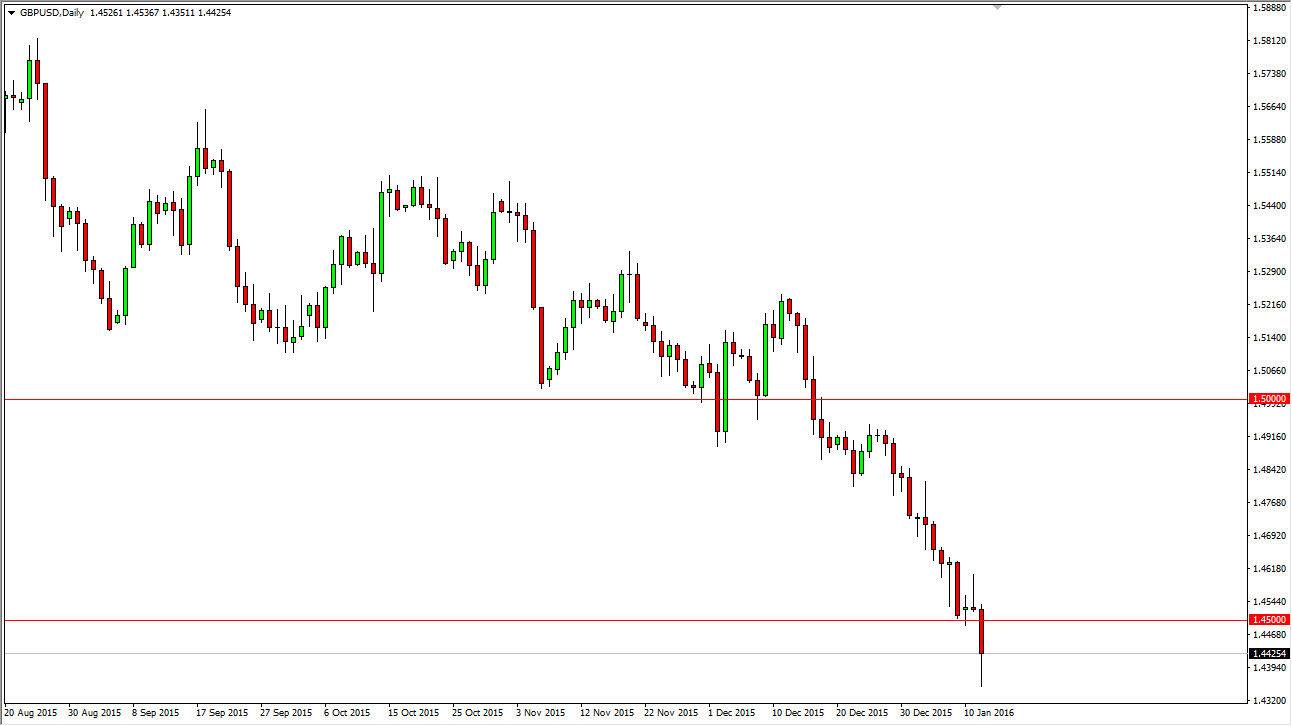

During the session on Tuesday, the British pound fell below the 1.45 level against the US dollar, an area that had been rather significant as far as psychological support is concerned. Now that we are down below that area, we could very well get a bounce in order to retest that area for resistance, something I fully anticipate seeing. With that being the case, I’m looking for short-term charts to show signs of exhaustion after a rally in order to start selling again. Quite frankly, I see there is more than enough resistance all the way to the 1.46 level, and as a result I think that the buyers simply cannot break above there.

Given enough time, I think that we drop down to the 1.43 level, and then eventually the 1.40 level. After all, we have made a recent “fresh new low”, and as a result it should signify that selling pressure will continue to the downside. At this point in time, it would take a longer-term bullish signal for me to consider buying.