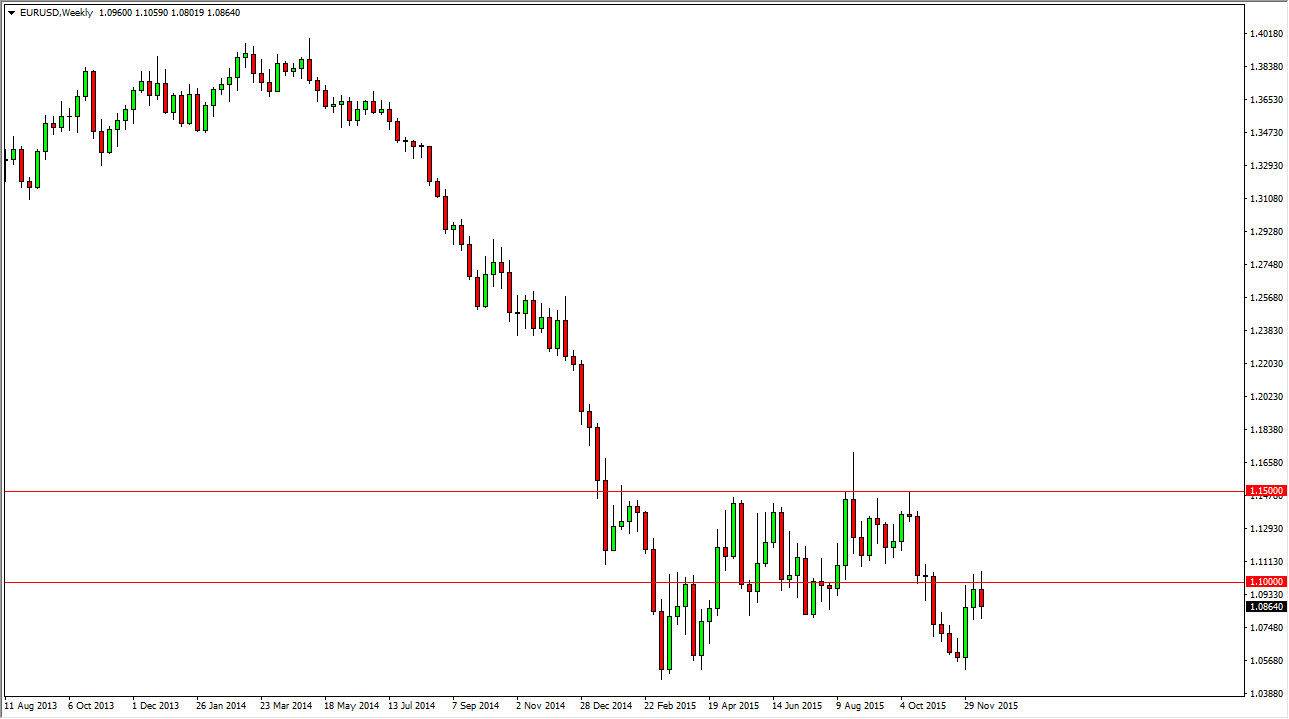

EUR/USD

The EUR/USD pair had a slightly negative week, completely wiping out the previous week. It appears that the 1.10 level will continue to bring in sellers, so I feel this point in time will more likely continue to bounce around between the 1.08 level on the bottom, and the 1.11 level on the top. I think short-term range bound trading is probably going to be the theme going forward.

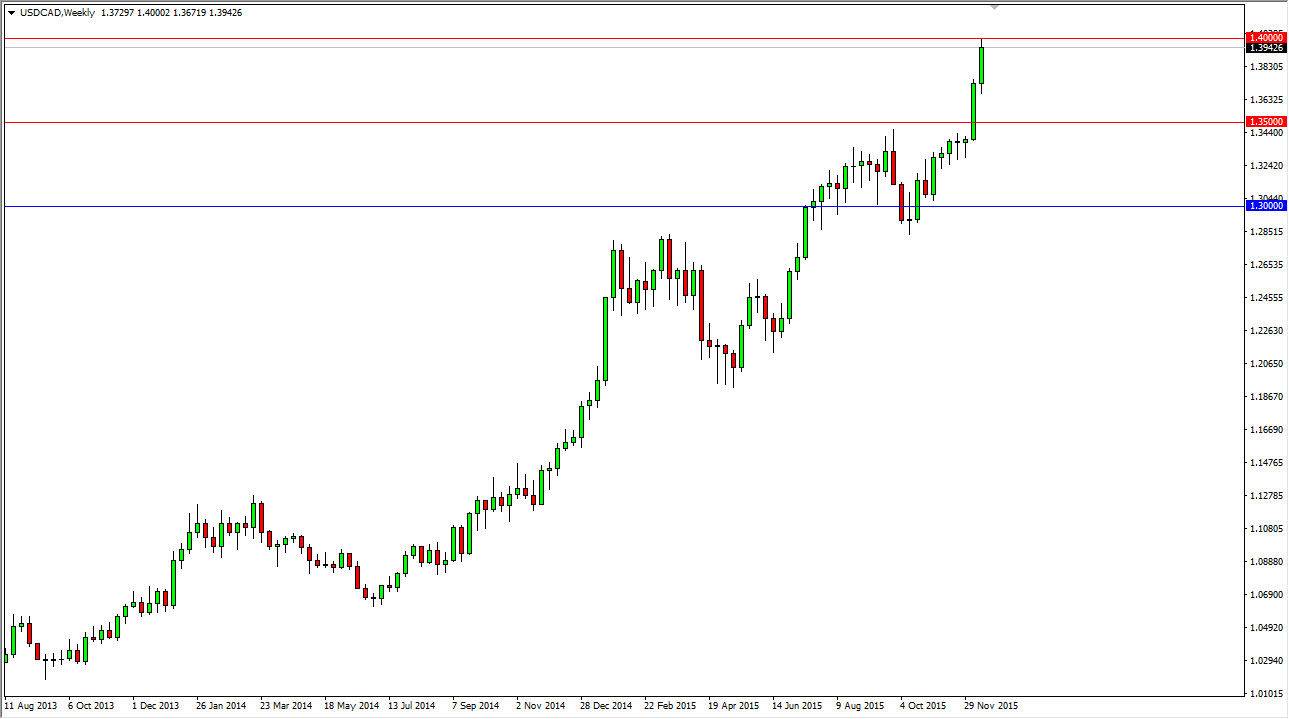

USD/CAD

The USD/CAD pair finally touched the 1.40 level during the course of the week. This is a market that I think should continue to go higher over the longer term, but at this point in time may very well need to pullback in order to build up momentum. That pullback should be looked at as value and a buying opportunity in the US dollar. I have no interest whatsoever in selling this market and believe that we will continue higher.

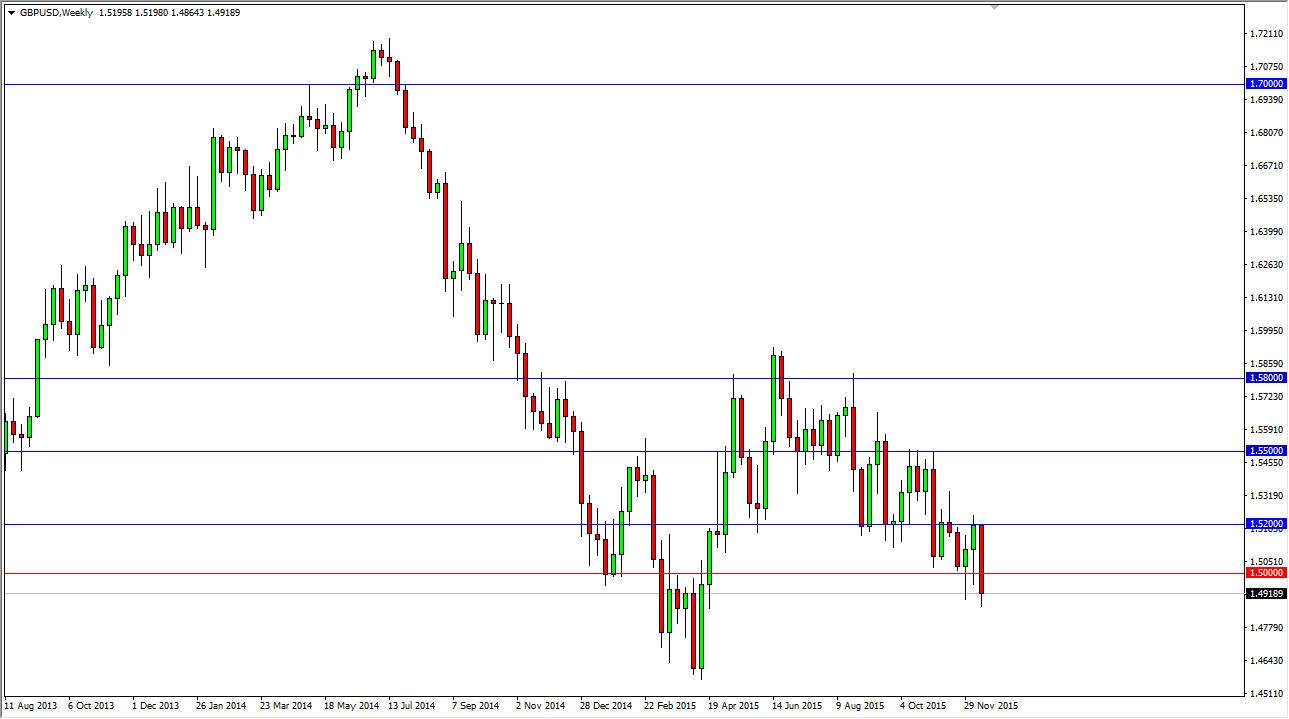

GBP/USD

The British pound struggled during the course of the week, slicing through the 1.50 level and closing beneath therefore the first time since March. Because of this, it appears that the market is ready to test the lows yet again, and as a result I am a seller of short-term rallies. I believe that this market should continue to the downside over the longer term but it will be more or less a grind lower, not some type of meltdown.

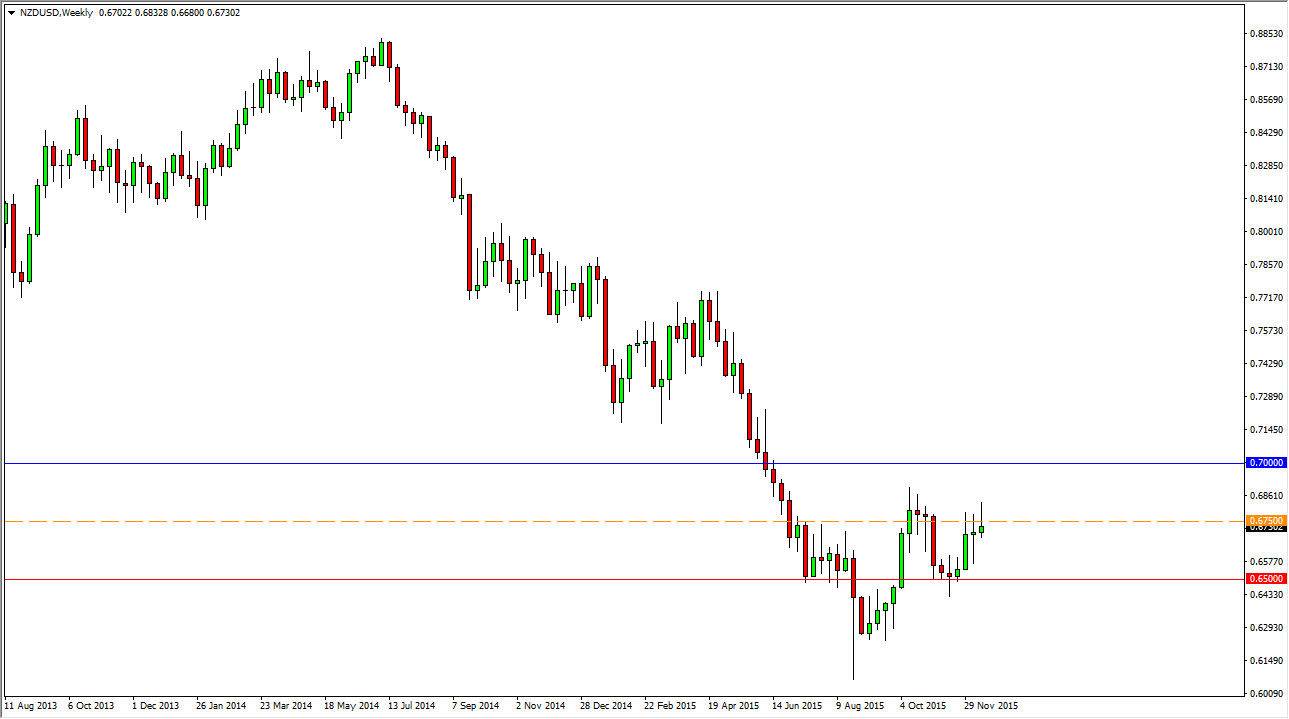

NZD/USD

The Kiwi dollar tried to rally during the course of the week but found the area above the 0.6750 level to be a bit too resistive to continue going higher. With that in mind, I believe that this market will continue to bounce around in this general vicinity, and therefore should be more or less a range bound trading type of market between the 0.6750 level and the 0.65 handle.