By: DailyForex.com

USD/JPY Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/JPY Signals

Risk 0.50%

Trades may only be taken from 8am New York time until 5pm Tokyo time.

Long Trade 1

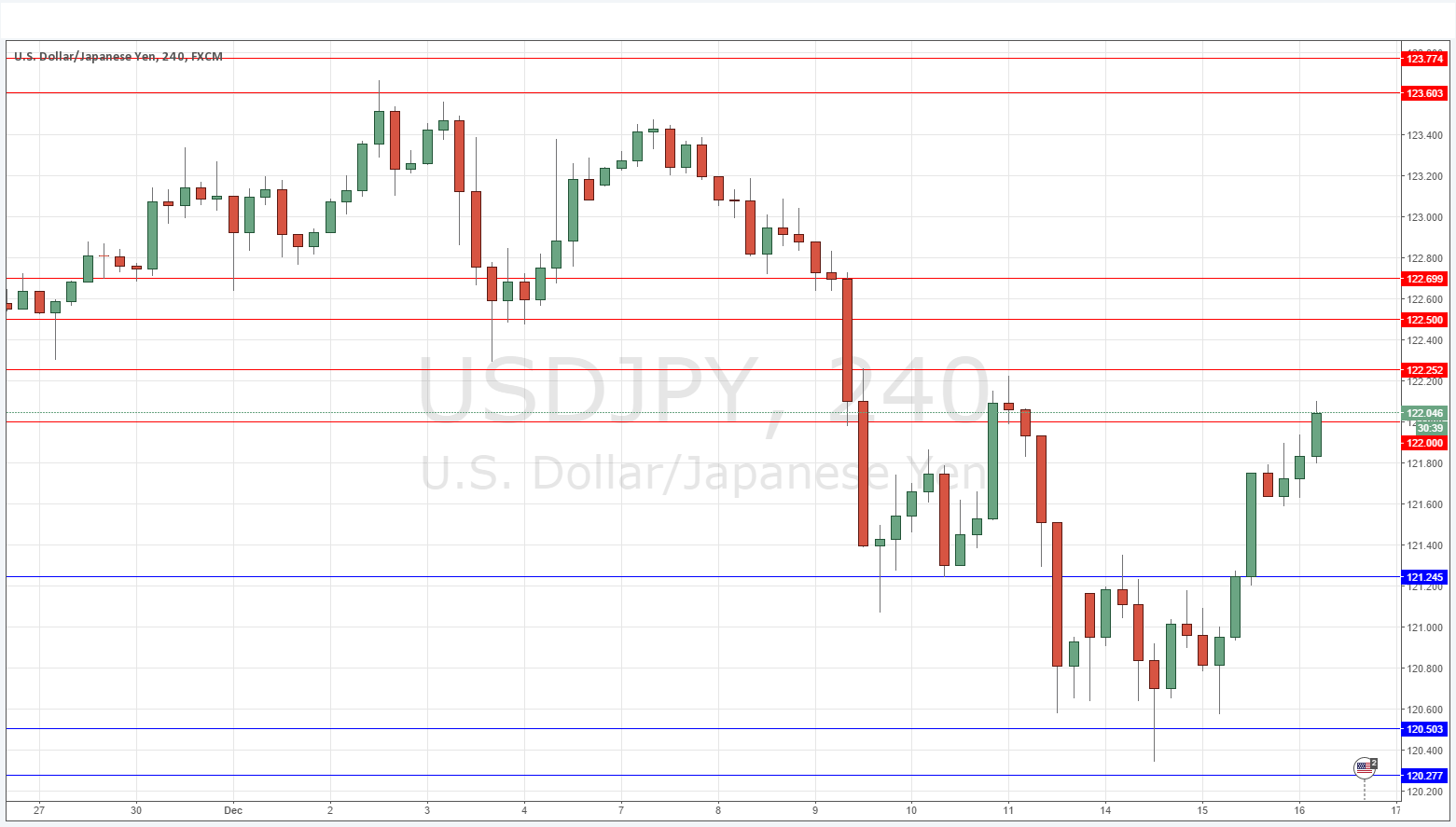

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 121.25.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 120.50

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.00.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.25.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 3

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.50.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 4

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 122.70.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/JPY Analysis

I wrote yesterday that the price had begun finding support over the past few days, following its sharp fall, and that a clean break above 121.25 would see a continued move up to the region of 122.25. This has come true over the past 24 hours, with the level of 121.25 seeming to flip cleanly from resistance to new support.

We have some bullish signs that after really going nowhere for a few months, this pair could take off again to the long side, and if the FOMC pass the rate hike later that could be the catalyst for a further move up to 123.00. However before we can turn fully bullish, the price really needs to get established above the 123.00 handle.

Should the Fed pass on the hike, the price of this pair could fall quite sharply.

There is nothing due today regarding the JPY. Concerning the USD, there will be a release of Building Permits data at 1:30pm London time, followed by the FOMC at 7pm.