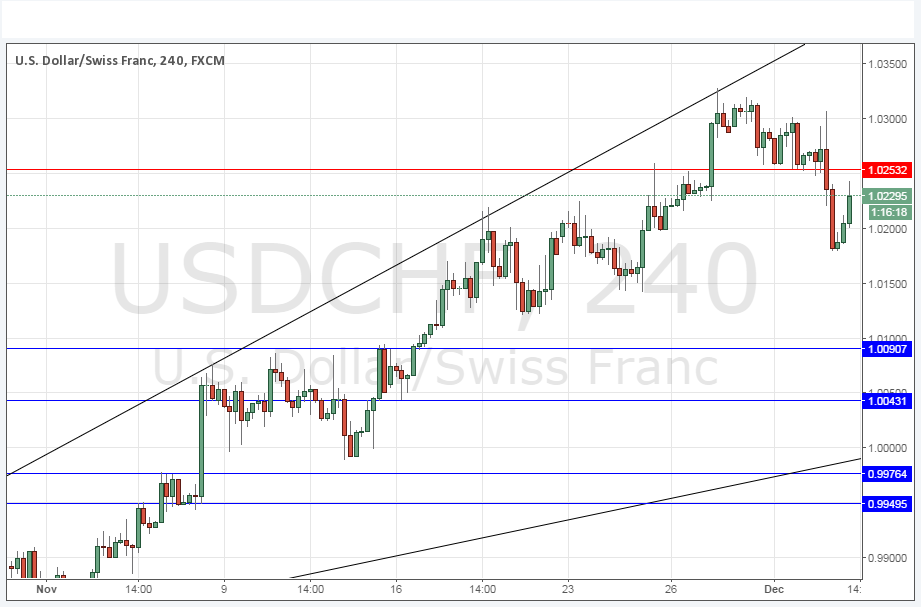

USD/CHF Signal Update

Yesterday’s signals produced a profitable long trade following a bullish engulfing candle rejecting the support level of 1.0253.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

* Go long after bullish price action on the H1 time frame following a touch of 1.0090.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 1.0253.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

Yesterday the pair was held as expected by the support at the key psychological level of 1.0250, eventually after a struggle rising to around 1.0300. However late during the New York session, the price fell sharply, breaking strongly down past 1.0250, which can now be expected to have flipped to resistance. There are no key support levels until quite a far way down and notably this pair has broken its long-term supportive channel trend line which has now been erased from the chart.

This would all be good analysis but there is probably going to be a great deal of volatility in the USD over the next 30 hours or so, as well as ECB talk on the Euro which will undoubtedly affect the CHF as these currencies are so closely intertwined. So technical levels might not be very useful during this period.

The shine seems to be coming off CHF weakness so if the news pushes the USD up it may be more beneficial to exploit that against the EUR than the CHF, although the difference in all likelihood might be quite small between those two currencies’ forthcoming price movements.

There is nothing due today regarding the CHF. the USD, there will be a release of Unemployment Claims data at 1:30pm followed by ISM Non-Manufacturing PMI and testimony from the Chair of the Federal Reserve.