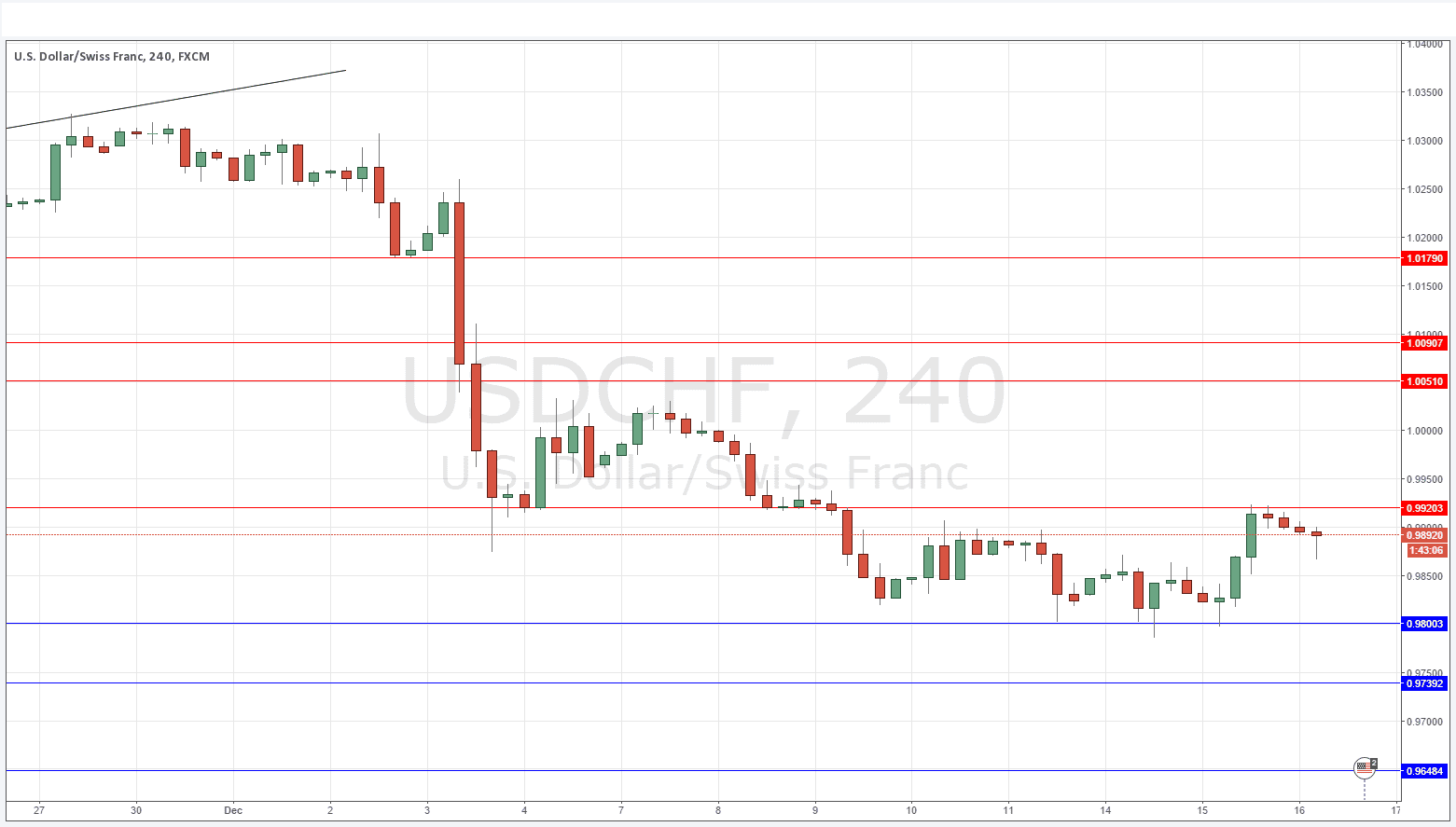

USD/CHF Signal Update

Yesterday’s signals expired without being triggered.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

* Go long after bullish price action on the H1 time frame following a first touch of 0.9800.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Go long after bullish price action on the H1 time frame following a first touch of 0.9739.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 0.9920.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 2

* Go short after bearish price action on the H1 time frame following a touch of 1.0051.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

I wrote yesterday that if 0.9800 held there could be a major upwards move, as it looks like a fairly major turn in price could be happening here. The level did in fact hold although unfortunately the momentum was not quite strong enough to trigger the London open long trade I included in yesterday’s analysis.

I thought that 0.9900 would be likely to be resistant but in fact it seems a level slightly beyond that has been key, at 0.9920. If the price can break past that later it has a great chance to make the next resistant level at 1.0051. Of course the FOMC release later today will quite probably see initial volatility that could take out 0.9800 again, but if a rate increase is announced it should be a good base for a strong rise in price.

There is nothing due today regarding the CHF. Concerning the USD, there will be a release of Building Permits data at 1:30pm London time, followed by the FOMC at 7pm.