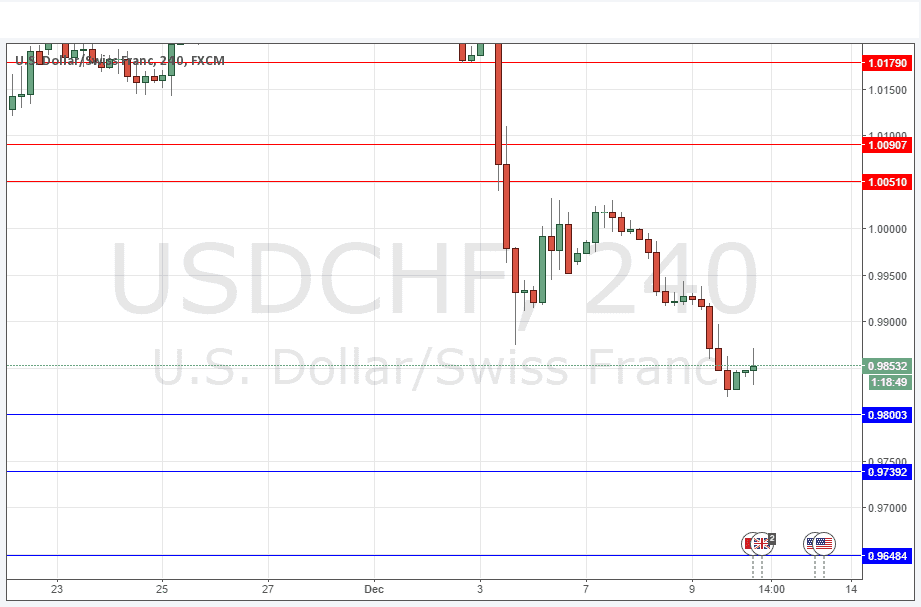

USD/CHF Signal Update

Yesterday’s signals might have triggered a profitable long trade, but the bullish price action really took place a few pips below the low of the supportive zone I highlighted so it was legitimate to leave it.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades must be entered between 8am and 5pm London time today only.

Long Trade 1

* Go long after bullish price action on the H1 time frame following a first touch of 0.9800.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Go long after bullish price action on the H1 time frame following a first touch of 0.9739.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short after bearish price action on the H1 time frame following a touch of 1.0050.

* Place the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

USD/CHF Analysis

This pair is very much moving in sync with EUR/USD these days, and yesterday was no exception.

The SNB just announced they are leaving the negative deposit rate of -0.75% unchanged, and that monetary policy remains expansionary. However the CHF has hardly moved, as at the time of writing. The SNB also said they think the value of the Franc is too high and they will move to intervene in the FX market if necessary.

If the pair does show signs of regaining upwards momentum, it will be in sync with the SNB’s stated policy.

Regarding the CHF, there will be releases of the SNB’s Monetary Policy Assessment and LIBOR Rate plus the usual press conference at 8:30am London time. Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm.