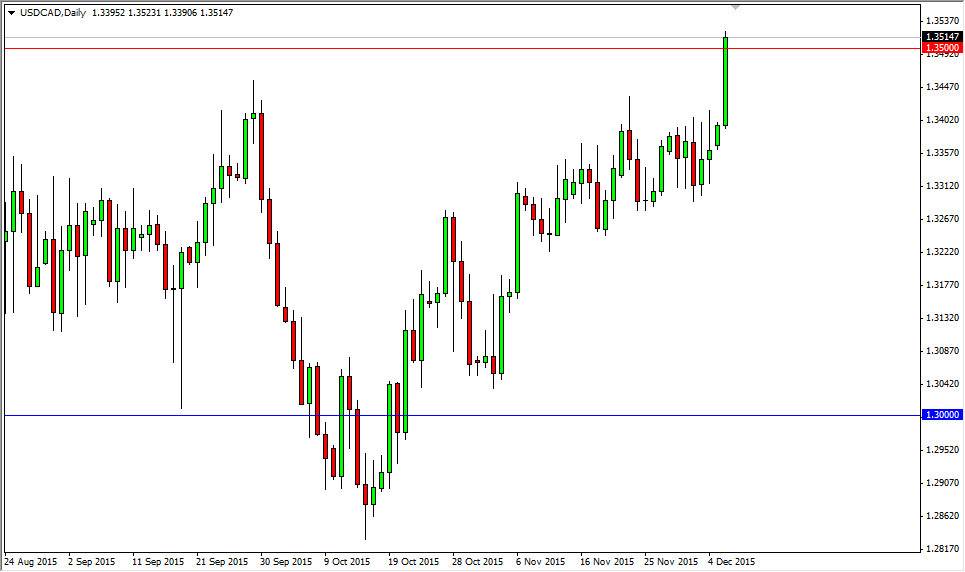

The USD/CAD pair broke higher during the course of the session on Monday, finally slicing through the 1.35 level that I have been watching for some time now. Because of this, I believe that we are getting ready to see a longer-term “buy-and-hold” type of move, and on a break above the top of the range for the day I am more than willing to start buying this pair. On top of that, I believe that the market will not only go higher, but go higher for the longer term as we could very easily see this longer-term uptrend continue.

Pullback should see plenty of support between here and the 1.34 level, and as a result I think pullbacks will offer value that you can take advantage of. Ultimately, supportive candles below should be buying opportunities. I think that the oil markets are ready to fall apart, and that of course will continue to weigh upon the value of the Canadian dollar going forward.

US Dollar Strength

The US dollar continues to be stronger than most other currencies, but as usual volatility will be the order of the day. Nonetheless, with the strength of this candle I think that we have seen the next move being set up. I think that selling isn’t even a thought though, as not only is there that support at the 1.34 level, but we are now well above the resistance barrier of 1.30 that had been so important during the financial crisis.

The US dollar continues to strengthen based upon the fact that the Federal Reserve is more than likely going to have to raise interest rates soon. On the other side of the spectrum, Canada is dealing with softening oil markets and as long as that’s the case the currency cannot hold out. On top of that, the domestic economy in Canada is doing nothing to convince the Forex world that the Bank of Canada will have to raise interest rates anytime soon either.