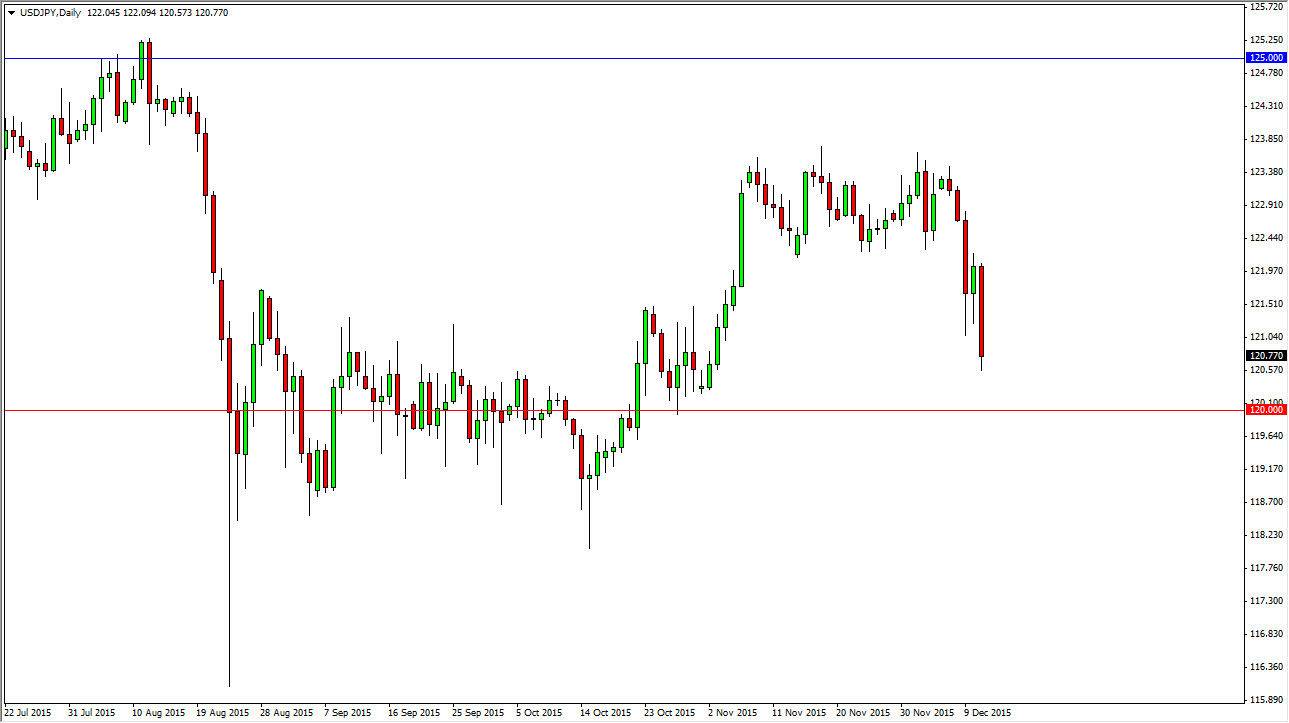

The USD/JPY pair fell significantly during the Friday session, as we broke well below the 1.1 handle. On top of that, we had a hammer on Thursday that has been broken below, and that of course is a negative sign as well. However, I am not interested in selling this pair because I believe there is more than enough support below to keep the market afloat. I think that this is going to be one of those times of people look back and see the value in the US dollar.

The 120 level is essentially the “floor” as far as I can see. However, it’s not just the 120 level. I think it extends all the way down to the 118.50 handle roughly, and as a result I am simply waiting to see whether or not we get a supportive candle or a bounce to take advantage of in this general vicinity. I think it will happen given enough time, as the interest-rate differential between both central banks should continue to diverge.

Buying Dips as Well

I believe in buying dips as well, so even when we do turn around, my work isn’t done. I will start with a small position as it will be the safest way to allocate money in what could be a fairly volatile market. Keep in mind that the holidays are almost upon us, and that of course will shrink liquidity in the Forex markets. Although this is a major pair, there will be quite a bit of volume missing once we get towards the end of next week.

I think that this will simply be an opportunity to take advantage of what has been a very well defended area, and as a result I think if you are patient enough you could very well find yourself picking up 2 or 3 handles on the bounce. I’m not looking for a massive breakout between now and the end of the year, and quite frankly the resistance barrier between the 124 and the 125 handles looks very tough. I think it will be broken eventually, but it’s going to take some time.