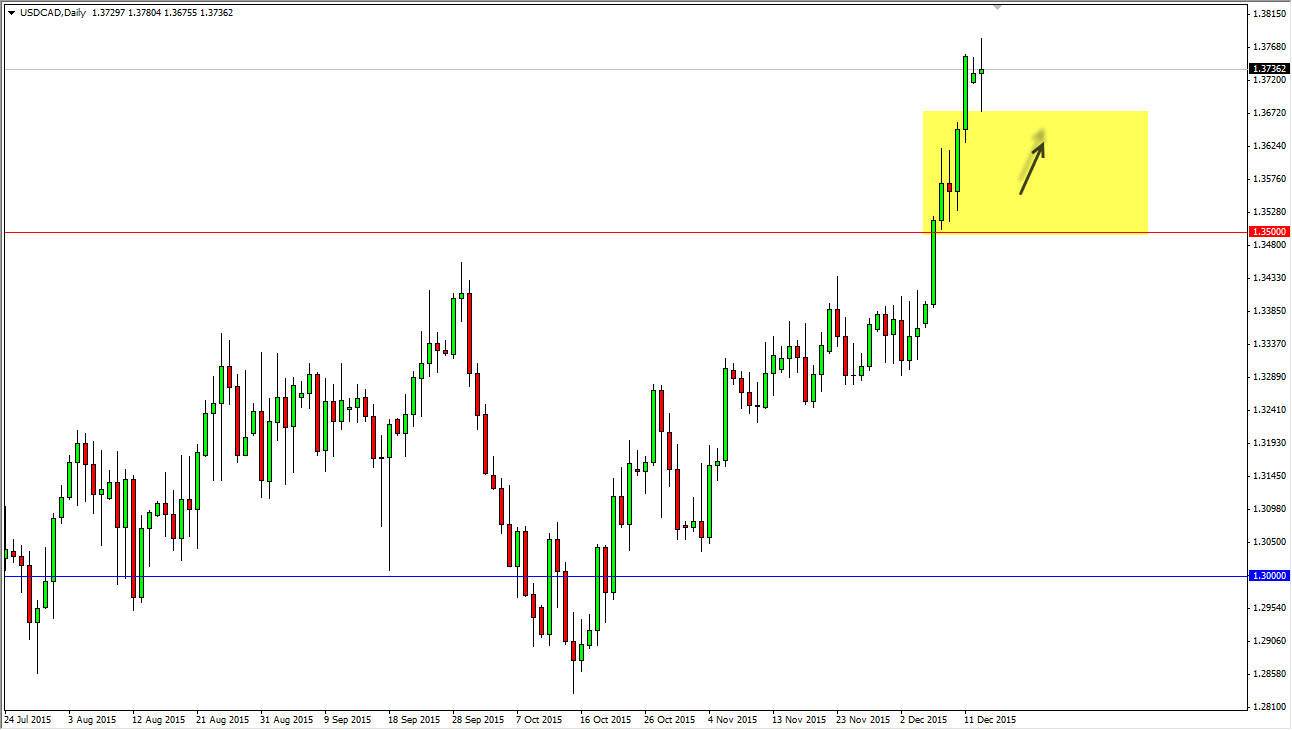

The USD/CAD pair went back and forth during the course of the day on Monday, essentially struggling to go anywhere once it was said and done. The market has been very bullish lately though, so having said that we feel it’s only a matter of time before the buyers get back involved in the market and push the value the US Dollar higher against the Canadian dollar.

The 1.35 level below was a significant resistance barrier, and it should now be a supportive level now that we have broken out above it. Because of this, it would not be surprising at all if the market fell back down towards that general area, and find plenty of buyers. I like the idea of picking up pullbacks as “value” in the greenback.

Oil

This pullback could coincide with what looks like a very likely bounce in the oil markets. After all, we formed hammers in both the Light Sweet Crude and the Brent market during the day on Monday. As the Canadian dollar is so highly leveraged to the oil markets, if oil bounces, it should bring strength back to the Canadian dollar, albeit for the short-term only.

If we get a bounce in the oil market, I actually going to wait for this market to pull back and try to find buyers below. Once we have that happen in the market and the buyers return, I am more than willing to pick up what should be an easy trade. Ultimately, I believe that this market will use this pullback as an opportunity to head up towards the 1.40 level, which has been a longer-term target mind for a while.

I have no interest in trying to short this market, as I see the “floor” being the 1.34 level. The support area is at least 100 pips that, so I think that the longer-term trend is most certainly going to continue to go higher.