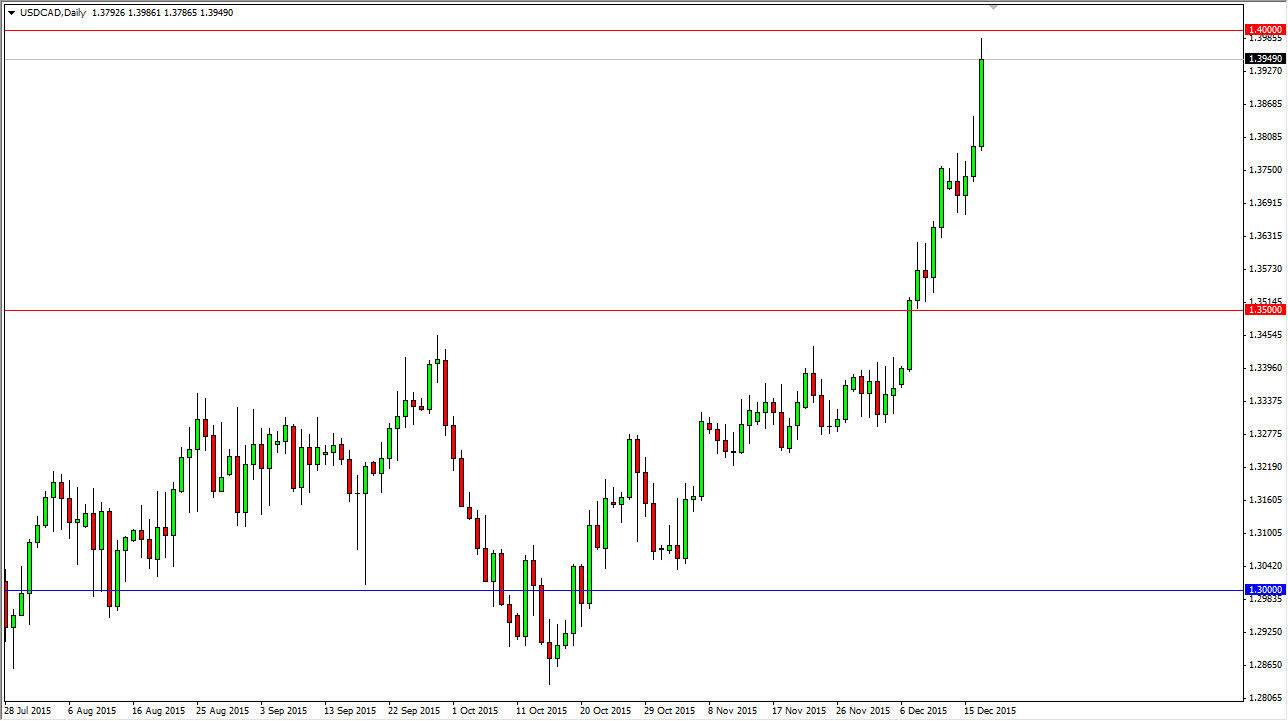

The USD/CAD pair broke higher during the course of the session on Thursday, clearing the top of the shooting star from the Wednesday session. In fact, we almost reached the 1.40 level which is been my longer-term target for some time. With that being the case, I feel that the market could very well pullback from here but I am not interested in selling this market right now. In fact, I believe it’s only a matter time before we break above the 1.40 level, but the fact is that the market is overbought at this point in time.

Any pullback from here should be supported, and as a result I am simply waiting for pullbacks and show signs of buying pressure in order to start going long again. The US dollar is the strongest currency in the world right now, and quite frankly I don’t want to work against it, especially with a commodity currency such as the Canadian dollar.

Oil Markets Coming Undone

Oil markets look like they are ready to come completely undone, and quite frankly there is no end in sight. The supply is far too strong for the demand to overtake, as we are currently drilling 2 million extra barrels a day. This wreaks absolute havoc on the Canadian dollar as it is used as a proxy for oil by Forex traders, and of course we have broken above significant resistance at the 1.30 level, and now it is essentially in what we would have to believe is a longer-term uptrend.

Every time this market pulls back, there should be more than enough buying opportunities going forward and I will simply be patient enough to find the market at lower levels, so we can build up enough momentum to finally break above the 1.40 level. I think at this point in time it’s difficult to imagine that this market is going to go higher for a significant move, because of the overbought conditions but certainly we are going to continue this bullish pressure over the longer term. I also believe that the Canadian dollar sells off against most other currencies.