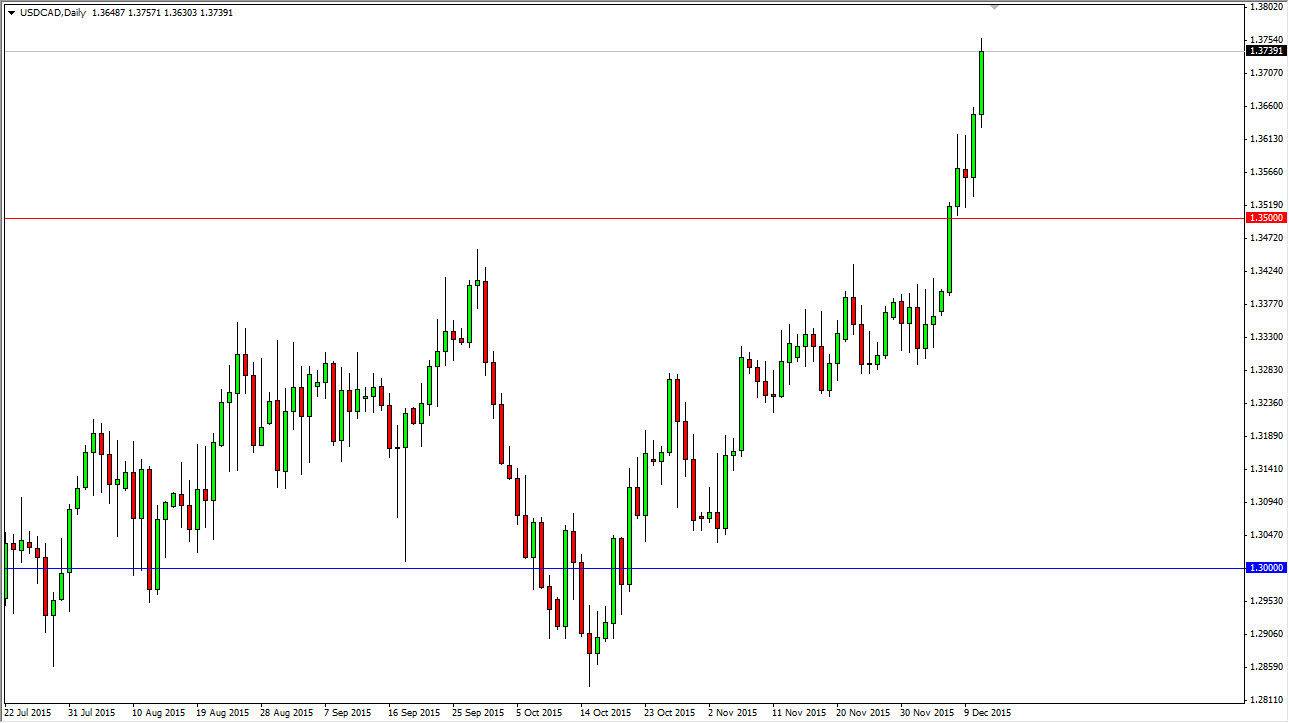

The USD/CAD pair broke out to the upside yet again during the session on Friday, and broke above the 1.37 level. I don’t necessarily think that the 1.37 level is significant in and of itself, but it does show just how much bullish pressure there is in this marketplace. I now believe that the 1.35 level will essentially be the “floor” in this uptrend, and it’s probably only a matter of time before we see this market try to reach the 1.40 level. At this point in time, the Bank of Canada has a lot of issues to deal with, and they most certainly will not be raising interest rates while the Federal Reserve is expected to this week.

Obviously, the statement will have a massive effect on what happens with the US dollar, and that will be the same over here in the USD/CAD pair. However, the in meantime I don’t see any reason why the US dollar would fall, especially against the Canadian dollar as it is a proxy for crude oil.

Crude Oil

At this point in time, the biggest drag on the Canadian dollar is going to be crude oil itself. We are in a situation where there is an excess of 2 million unused barrels of oil being shipped into the marketplace every day. This of course is very bearish for pricing, and should continue to keep the crude oil markets going lower, which by extension will absolutely decimate the Canadian dollar.

It’s not a total despair though, because quite frankly we are still at historically low levels. This is a market that has a long way to go to the upside in my opinion, and therefore I think every time this market dips, you have to be thinking about buying as there is more than enough pressure to the upside and more than enough external pressure on the Canadian dollar to continue to see much higher levels.