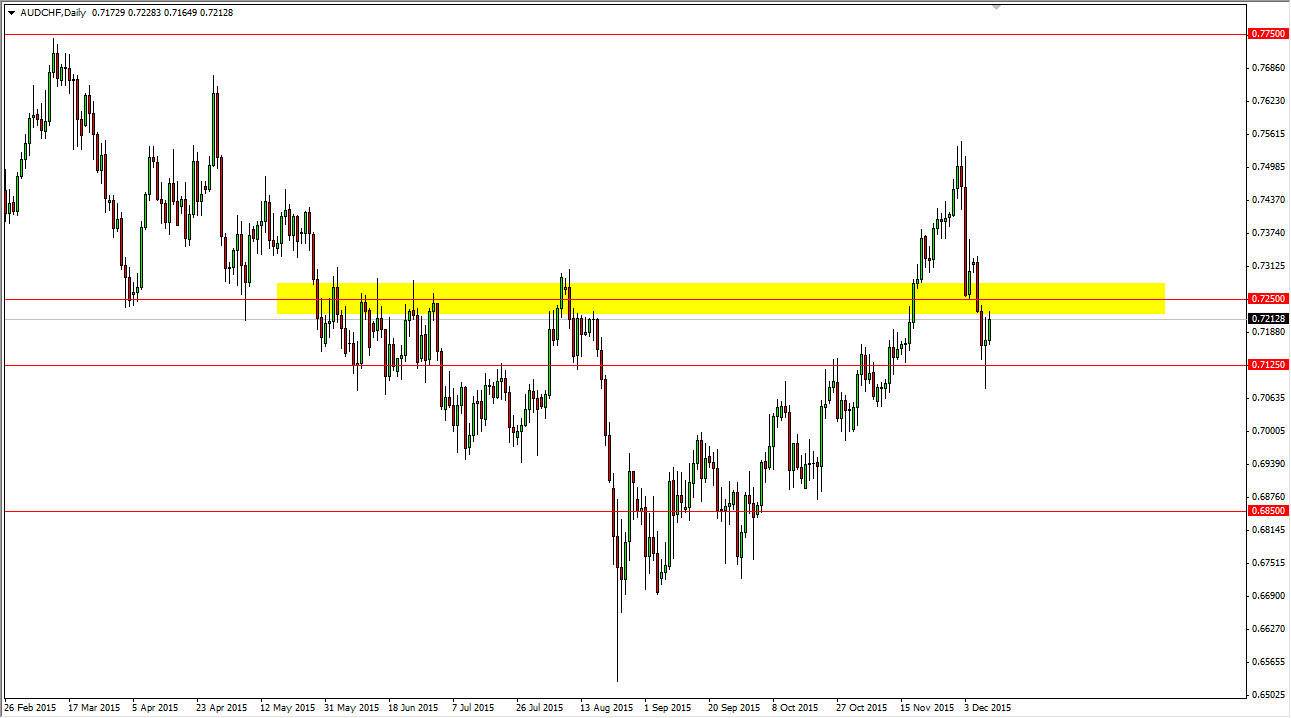

The AUD/CHF pair had a positive session on Thursday, testing the 0.7250 level. By breaking above the top of the hammer that formed on Wednesday, it looks as if the market is ready to go higher. However, I do see a bit of resistance at the 0.7250 level that must be overcome. If we can break above there, the market should continue to go much higher, such as the 0.74 level. After that, I anticipate a move to the 0.75 level.

Keep in mind that the Swiss franc is losing value in general, so it makes sense that we would continue to grind higher. I don’t think that this will be the easiest market in the world to hang onto, but I do recognize that the market certainly has quite a bit of bullish pressure underneath it. With that being the case, I don’t want to short this market under any circumstance, at least not until we break down well below the hammer from the Wednesday session, something that I don’t think that’s going to happen anytime soon.

Overall Uptrend

I believe that this market is trying to an enter an overall uptrend. We have a nice trend line just below the hammer from the Wednesday session, and of course we have already broken through the resistance just above, which normally means that it is a bit softer than it once was. Also, you have to keep in mind that the Australian dollar represents something completely different than the Swiss franc does.

The Australian dollar is starting to strengthen a bit against the Swiss franc not necessarily because the gold markets are rising, but more because the fact that people are being forced into riskier assets. On top of that, the Swiss franc is being worked against buying the Swiss National Bank, and I believe that it will continue to soften in general. The Swiss have the misfortune of being stuck in the middle of the European Union, and therefore they will continue to struggle as the Swiss have to rely on Europeans to buy most of their exports.