NZD/USD Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s NZD/USD Signals

Risk 0.75%

Trades must be entered from 8am New York until 5pm Tokyo times today only.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6700.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of the bullish trend line currently sitting at around 0.6655.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Long Trade 3

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.6600.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.6872.

* Put the stop loss 1 pip above the local swing high.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Remove 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to run.

NZD/USD Analysis

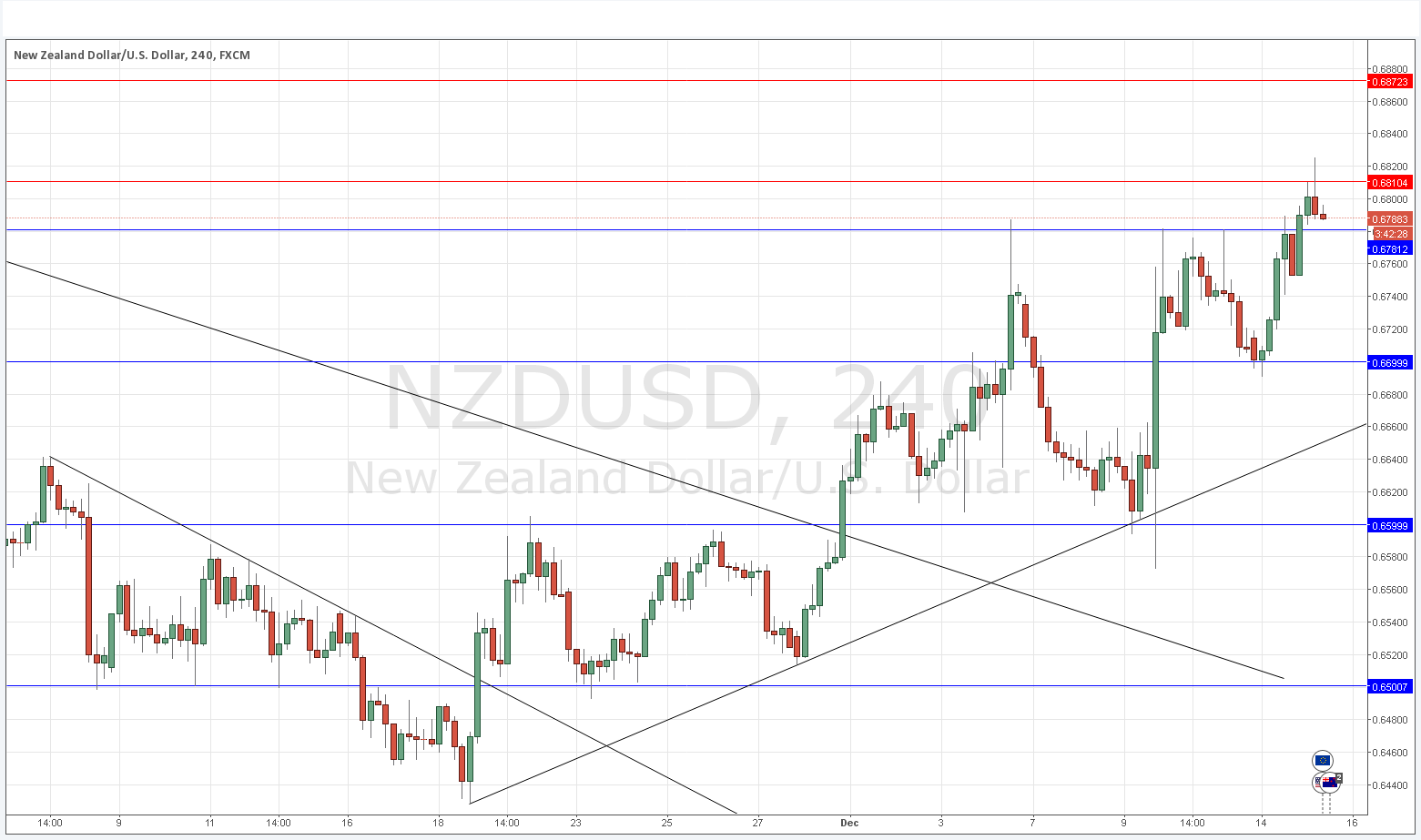

This is the most bullish pair against the USD. Looking at the chart below we can see there is a clear recent upwards trend, with repeated breakings of support. This means that if the USD disappoints – as the Fed may do tomorrow if they do not hike rates for any reason – the place to be is quite likely to be long this pair, NZD/USD.

It is also very significant that we are approaching resistance at 0.6872 as it is around this area that we will be above prices 6 months ago: we are already well above the price 3 months ago. All this suggests that we are not far from a strong bullish trend becoming established.

However it is quite likely that the USD will regain some strength, in which case we may have already made a medium or long-term high off the resistance at 0.6810. A break below the triple top at 0.6780 might signal a fall back to 0.6700 if it happens in the next few hours.

There is nothing due today regarding the NZD. Concerning the USD, there will be a release of CPI data at 1:30pm London time.