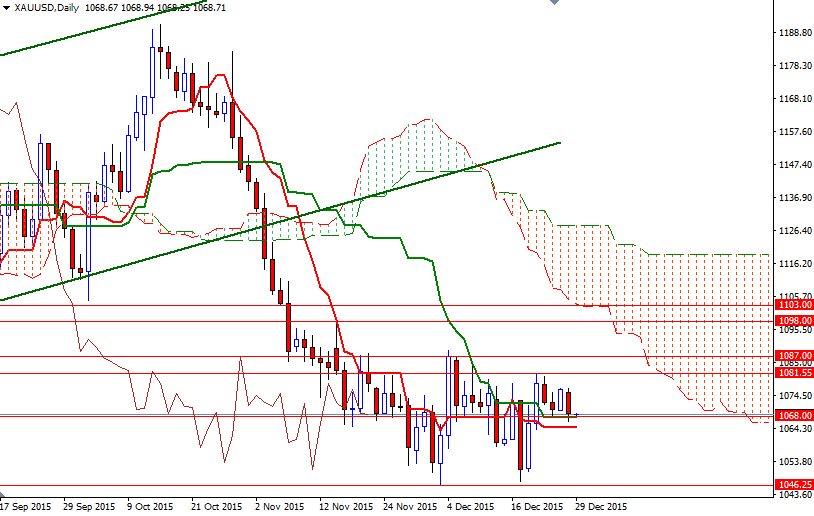

Gold prices settled lower on Monday, giving up some of last week's gains, but remained coiled within the recent trading range in thin liquidity. The precious metal has been trapped roughly between the 1081.55 and 1066 levels for the last five sessions. The trading action is getting tight and as you can see on the daily chart the candlesticks are indicating a real lack of momentum.

As the key levels are holding, it appears the XAU/USD is likely to remain range-bound for the remainder of the week. Yesterday's data from the Commodity Futures Trading Commission (CFTC) showed that speculative traders on the Chicago Mercantile Exchange increased their net-long positions (driven mostly by short covering) in gold to 26427 contracts, from 13656 a week earlier. From a long-term perspective, trading below the Ichimoku clouds on the weekly and daily time frames indicates the bulls are not strong enough to dominate the market.

In the meantime, I will keep an eye on the aforementioned key levels. If the 1081.55 resistance is cleared, it is quite possible that the XAU/USD pair will continue to grind higher. In that case, I think the bulls will be targeting the next barrier in the 1089/7 region. Only a daily close beyond that level could give the bulls some extra fuel they need to test the 1094 resistance level. On the other hand, if the bears take the reins and drag the market below 1066, the next stop will be the 1064.50 level where the bottom of the 4-hourly Ichimoku cloud sits. A successful break below 1064.50 could trigger some extra pressure that can take XAU/USD back to the 1058 support.

.png)