Gold prices settled higher on Thursday, recouping some of the recent losses, as the weakness in the dollar and equities markets lured some investors back into the market. The world's major bourses suffered bruising losses and the greenback slipped after a package of measures unveiled by the European Central Bank unveiled fell short of expectations. The ECB cut its deposit rate by 10 basis points to -0.3% and said it will extend asset-buying program by six months until at least March 2017 at the current rate of €60 billion a month.

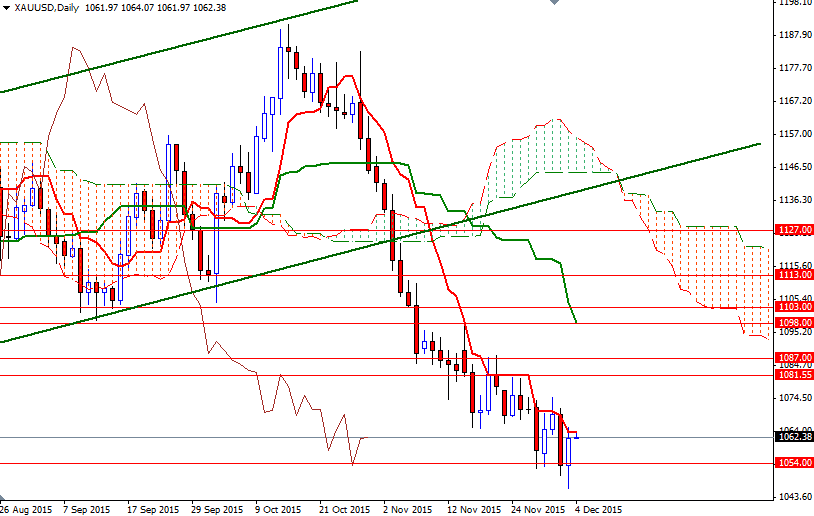

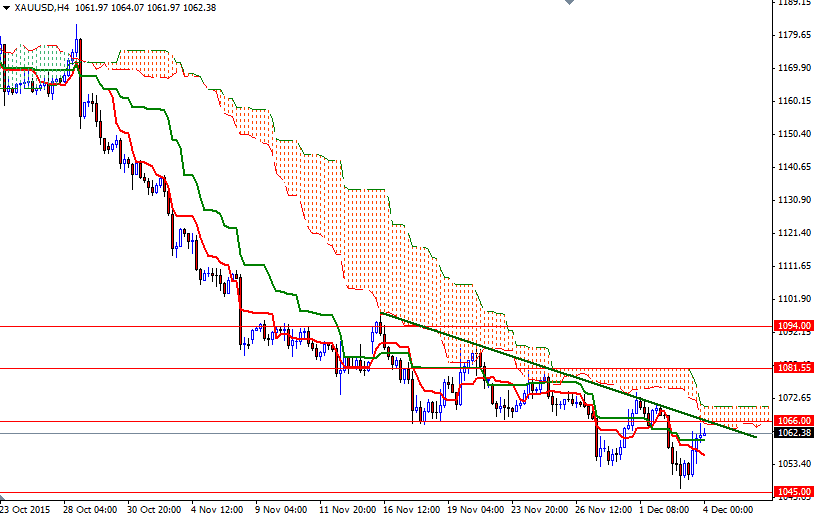

However, gains were limited as investors awaited the November U.S. payrolls report. The Federal Reserve is widely expected to hike rates later this month. "To simply provide jobs for those who are newly entering the labor force probably requires under 100000 jobs per month," Fed Chair Yellen told Congress’s Joint Economic Committee yesterday. The XAU/USD pair tested the 1066/5 region after the market found some support above the 1045 area. But as you can see on the 4-hour time frame, this region where a short-term descending trend-line and the bottom of the Ichimoku cloud line up has been preventing the market from going higher.

The 4-hourly Ichimoku cloud occupies the area between the 1065 and 1070.40 and there is nearby resistance just above at 1073. Therefore, I assume prices won't have much room to rise unless 1073 is breached. If the XAU/USD pair anchors above 1073, the 1081.55 level will be the next port of call. Closing above 1081.55 would make me think that the bulls are ready to tackle the next barriers at 1088/7 and 1094. To the downside, the initial support stands at 1059.75, followed by 1054/3. The bears have to drag prices below this area if they intend to make another assault on the 1045/2 key support.