Gold settled down $2.04 at $1072.57 on Wednesday but remained within the trading range of the past 5 days as the battle between the bulls and bears for supremacy continued. Although the precious metal found some support from a weaker dollar recently, it appears that the majority of market participants opt to remain on the sidelines ahead of next week's Federal Open Market Committee meeting at which the U.S. central bank is expected to deliver a rate hike.

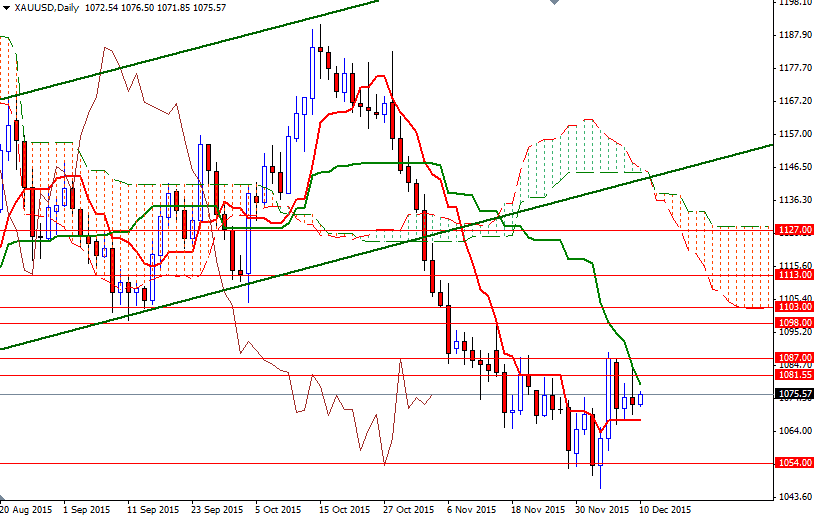

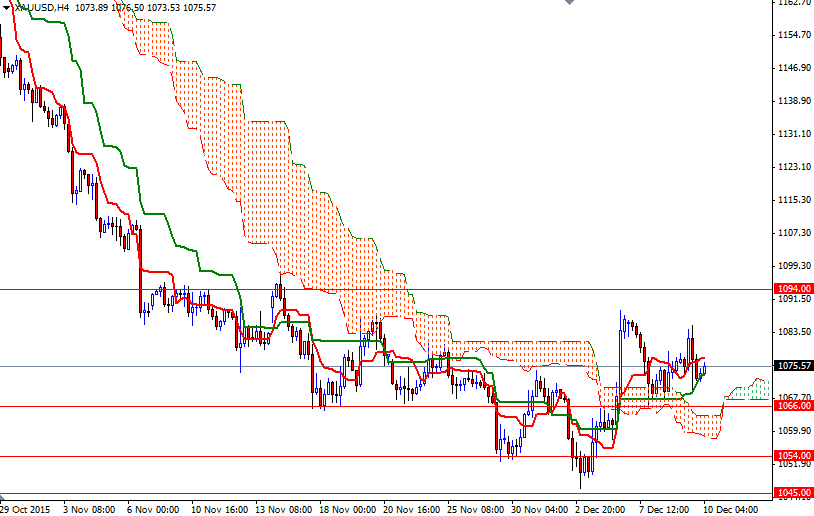

Gold prices are trading slightly higher during the Asian session but the key levels are holding. The long-term technical picture for gold is still weak, with the market trading below the Ichimoku clouds, as well as negatively aligned Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines. However, prices are above the 4-hourly cloud and we have a bullish Tenkan Sen - Kijun Sen cross on the same chart.

At this point, the XAU/USD pair will have to either break through the 1087 level and challenge the next barrier at 1094 or drop below the 1066/4 region and start a journey to the 1054 level. While a sustained drop below this zone would prolong the bearish momentum and open up the risk of a move towards 1045, clearing the resistance at 1094 would make me think that the bulls are ready to tackle the next barriers at 1098 and 1103.