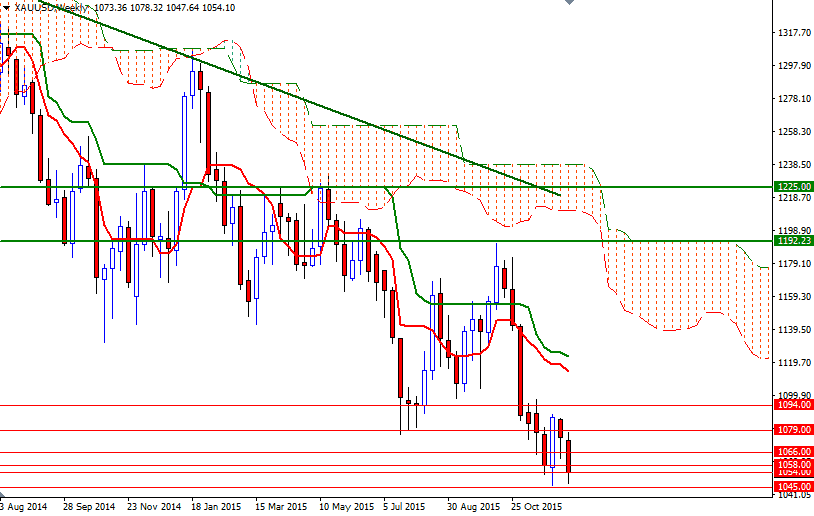

Gold prices sank 2% and closed at a fresh six-year low on Thursday as strength in the dollar weighed on the market and drew investors away from the precious metal. The XAU/USD pair has come under renewed selling pressure since the U.S. central bank ended the era of record-low interest rates. On the economic data front, Philadelphia Fed's manufacturing index came in weaker than expected with a print of -5.9 but a separate report released by the Commerce Department showed that jobless claims dropped by 11K to 271K.

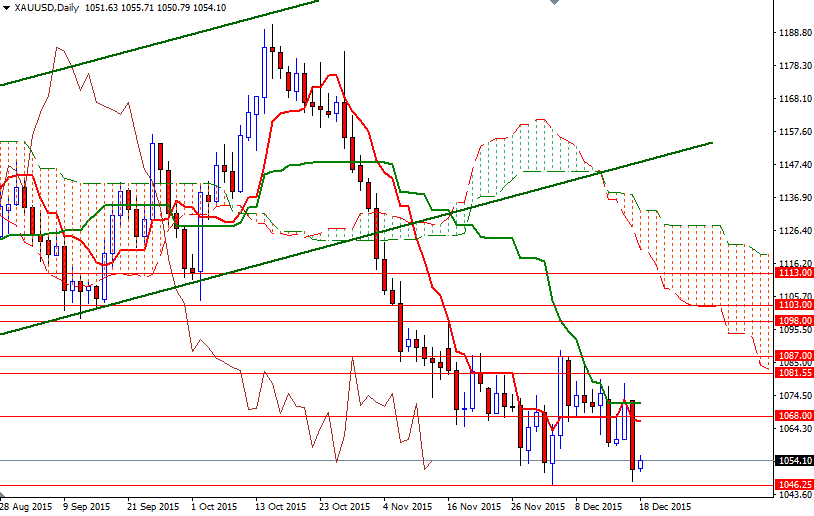

The market's inability to hold above the 1066 level was also behind today's decline. The XAU/USD pair retreated to 1058 right after the 1066 support gave way. Not surprisingly, breaking below 1054 attracted additional sellers and consequently extended losses. The 1046.25 - 1045 area down below is likely to offer some support but if the bearish momentum continues today and prices break below that, our next stop will probably be the 1036 level. Once below that, there will be little to slow this pair down until we reach the next key support in the 1025/17 zone.

However, if we make a double bottom here and XAU/USD holds above 1054, we could see a push up to 1058. Beyond that expect to see some resistance at the 1063 level where the Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines coincide on the 4-hour time frame. The bulls have to push prices above at least 1081.55 and preferably 1087 in order to alter the short term technical picture.