Gold prices rose on Friday, breaking a two-session losing streak, as some investors sought safety from volatility in global equities. The Nasdaq Composite sank 2.21%, the Dow Jones Industrial Average dropped 1.76% and S&P 500 fell 1.94%. European and Asian stocks deepened their losses. Despite Friday's gains gold ended the week down nearly 1% at $1075.16 an ounce on anticipation of tighter U.S. monetary policy.

The pressure on gold remains because of the Fed’s plans to raise short-term interest rates. The government figures on Friday kept the Federal Reserve on track to start normalizing policy this week. Although some people are concerned the Fed will finally pull the trigger, I think it is going to be what chair Janet Yellen says at the press conference that will matter the most. She has been trying to assure markets that the Fed intends to pursue a gentle tightening path. Until the Fed's announcement, it is unlikely investors will make big bets in either direction.

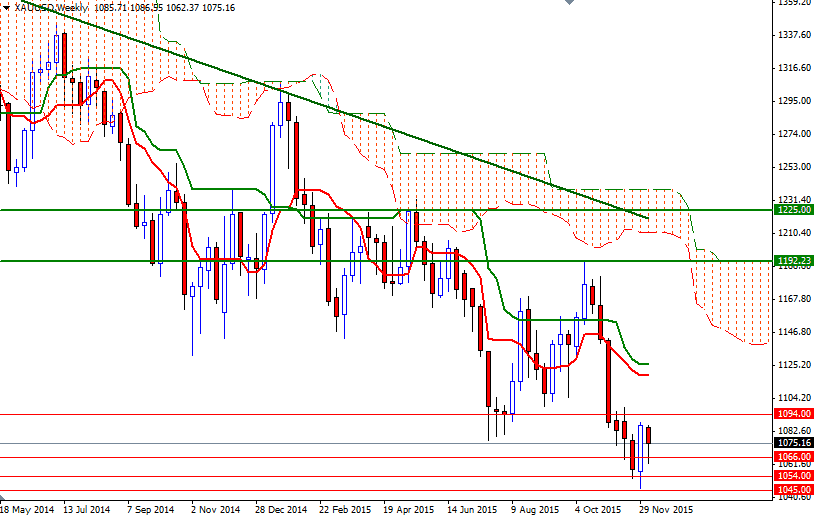

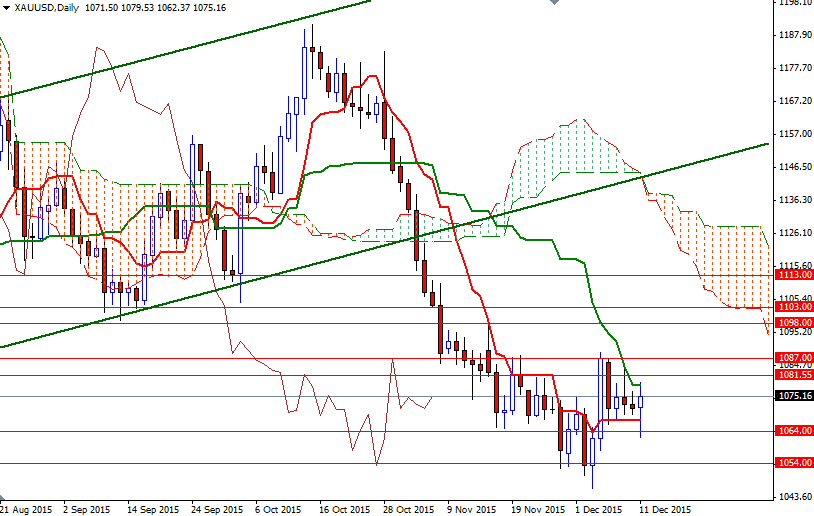

Completely flat weekly and daily Tenkan-Sen (nine-period moving average, red line) and Kijun-Sen (twenty six-period moving average, green line) lines also support this theory. Besides, the market won't have much room to move as long as prices are trapped inside the same area in which they spent some time during mid to late November. If the 1066/4 region holds, I will look for XAU/USD to visit the daily Tenkan-Sen sitting at 1079 and perhaps 1081.55 just above that. A break up above 1087 could see an extention to the 1094 level. On the other hand, if the bears successfully breach the aforementioned support, it suggests a move back down to 1058 and 1054. Closing below 1054 on a daily basis favor a test of multi-year lows at 1046.25.