Gold prices are lower in Asia trade, trading down nearly 0.6% at $1066.76 an ounce, as the dollar strengthened after the Federal Reserve set the new target range for the federal funds rate at 0.25% to 0.5%. In a press conference after a two-day meeting, Fed Chair Janet Yellen said "The committee currently expects that, with gradual adjustments in the stance of monetary policy, economic activity will continue to expand at a moderate pace and labor market indicators will continue to strengthen." She also emphasized that "gradual does not mean mechanical, evenly timed, equally sized, interest-rate changes. As the outlook evolves, we’ll respond appropriately. I strongly doubt that it will mean equally spaced hikes."

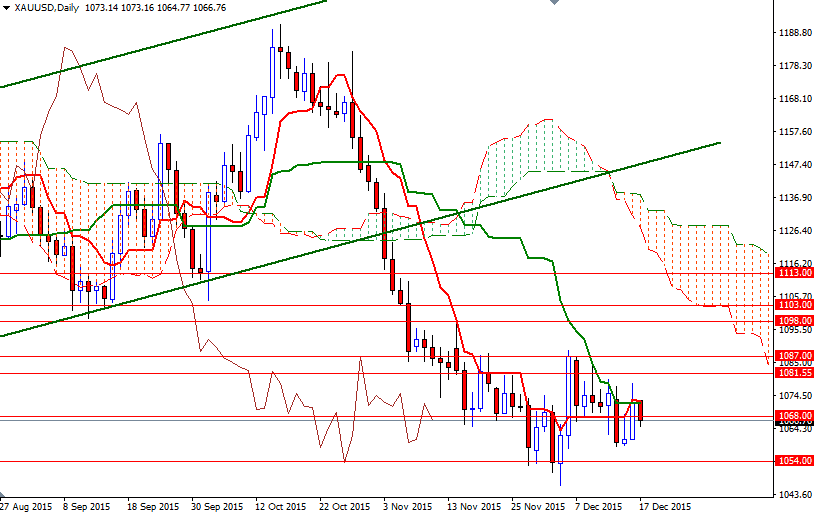

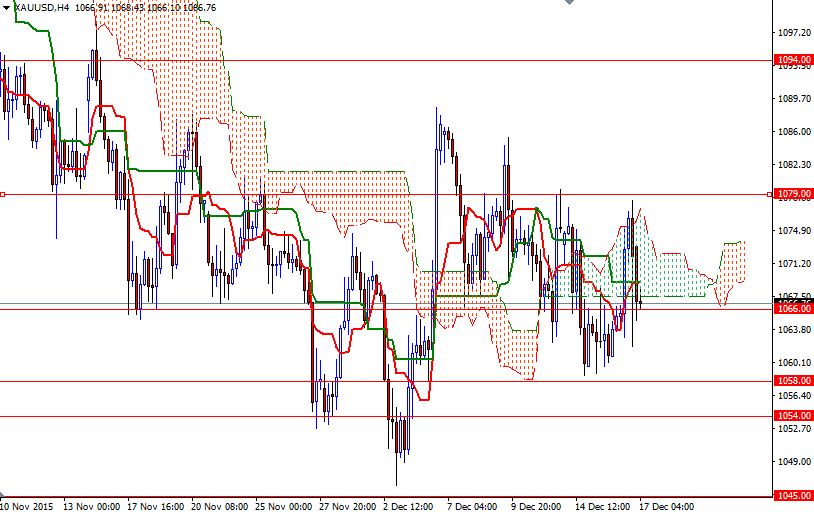

The Federal Reserve's 25-basis-point increase definitely put some pressure on the market but anyway I will be paying attention to technical levels as always. The area at around 1066 provided some support so far. Therefore, we need to get down below there in order to continue to the downside. If the XAU/USD pair fails to hold above 1066, then it is likely that the market will head towards the 1058 level. The bears have to capture this camp so that they can make an assault on the 1054 support level.

To the upside, there are hurdles such as 1079 and 1081.55. The XAU/USD pair has to push its way through the 1081.55 level in order to gain more traction and tackle the next solid resistance at 1087. If the market can cleanly break above the 1087 level, we could see a bullish run targeting the 1094 and possibly 1098 levels.