Gold prices advanced more than 2% on Friday to settle at their lowest level since November 11, helped by a softer dollar and hopes that the pace of interest rate increases in the U.S. would be slow and in small increments. The argument for getting into the hiking cycle before the end of the year was bolstered by the government's latest jobs report, which showed the economy added 211K jobs (gains for the prior two months were revised up by a total 35000) and average hourly wages increased 0.2% in November. But last week Federal Reserve Chair Janet Yellen said that "This may turn out to be a very different cycle than past cycles," - hinting that rates remain below normal for years to come.

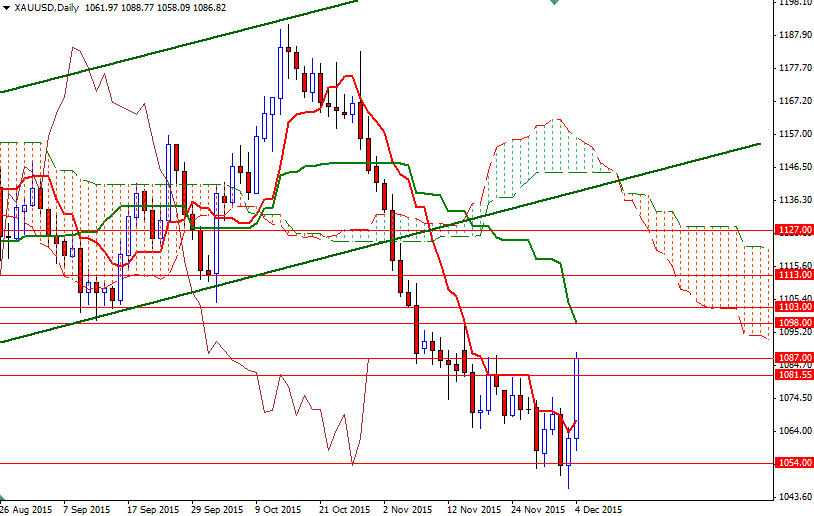

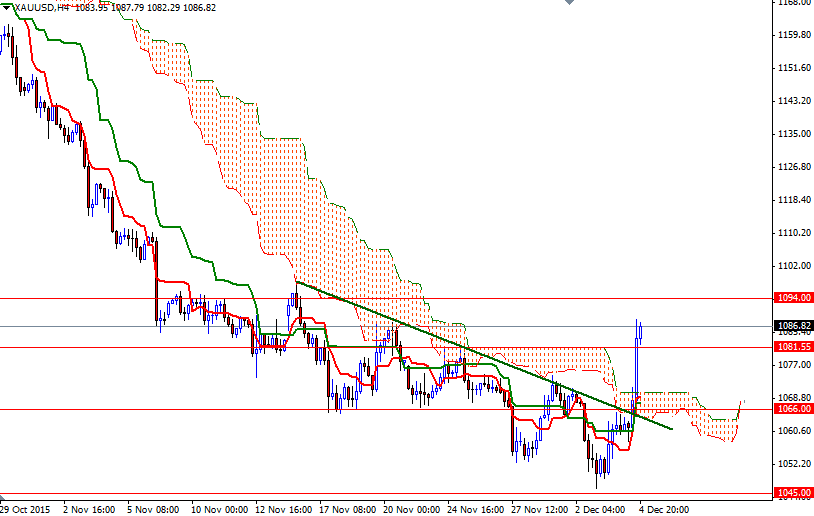

The XAU/USD pair has rebounded nearly 4% since the market bounced off the 1046.33 level hit on Thursday. Speaking strictly based on the charts, the long-term charts will remain bearish until the market breaks out of the descending channel, which prices have been running in since July 2013, and anchors somewhere above the weekly Ichimoku cloud. However, Friday's rally pushed prices above the 4-hourly Ichimoku clouds. In addition to that, the Tenkan-Sen line (nine-period moving average, red line) crossed over the Kijun-Sen (twenty six-period moving average, green line) and the Chikou Span (brown line) climbed above prices. In other words, the recent upswing may remain intact as long as the market can hold above the 1073/0 area.

That said, it looks as if we are heading up to 1105/3 which is likely to act as effective resistance in the short-term. But of course, in order to reach there, the bulls will have to push through 1094 and then 1098. A successful break above 1105 could open a path to 1115/3. On the other hand, a failure to sustain a push above 1087 might weigh on the market and pull XAU/USD back to test the support at 1081.55. If this support is broken, it would be technically possible to see the market heading back to 1073/0 region. Once below that, the bears will be aiming for 1066/4.