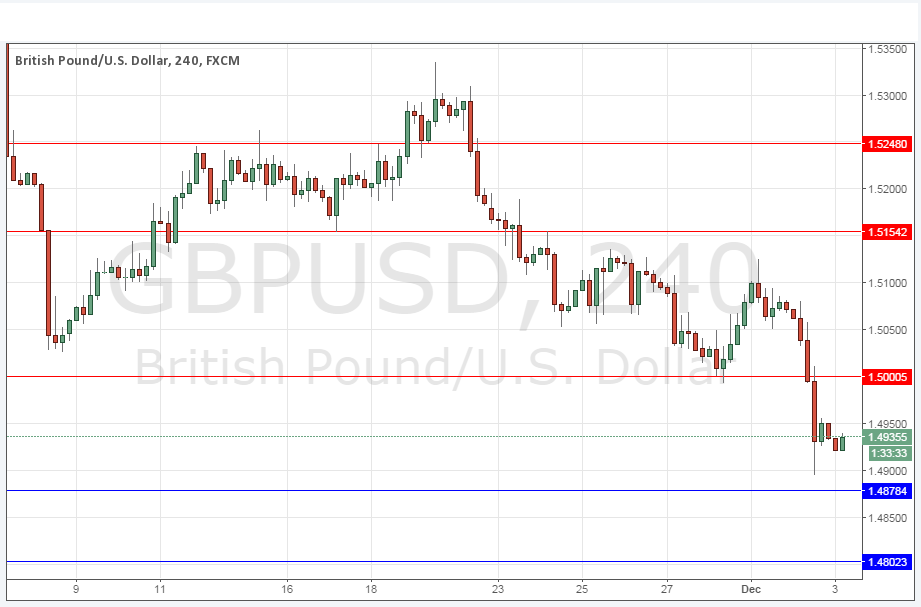

GBP/USD Signals Update

Yesterday’s signals expired without being triggered as there was no bullish price action at any of the key levels specified in yesterday’s forecast.

Today’s GBP/USD Signals

Risk 0.75% per trade.

Trades may only be entered between 8am and 5pm London time today.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4878.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 1.4802.

* Place the stop loss 1 pip below the local swing low.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the trade is 25 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5000.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 1.5154.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 25 pips in profit.

* Take off 50% of the position as profit when the price reaches 25 pips in profit and leave the remainder of the position to ride.

GBP/USD Analysis

Over the last 2 or 3 weeks I have been expecting a large and fast move down in this pair, although I was not expecting it to happen yesterday. It had looked like the support at 1.5000 was strong. In any case the pair made a large 1 day fall, breaking below three key support levels and at one point even trading below 1.4900 before pulling back a little.

Technically this means that all that support was just blow away. The only level that looks to have flipped is 1.5000 and that is not surprising as it is such a big number.

This pair is going to be very affected by the big EUR and USD news that is coming today and tomorrow. However there is UK news due before that which is negative could push the price down to the next key support at 1.4878 quite easily.

This pair looks very weak.

Regarding the GBP, there will be a release of Services PMI data at 9:30am London time, Concerning the USD, there will be a release of Unemployment Claims data at 1:30pm followed by ISM Non-Manufacturing PMI and testimony from the Chair of the Federal Reserve.