By: DailyForex.com

The difference between success and failure in Forex trading is very likely to depend upon which currency pairs you choose to trade each week, and not on the exact trading methods you might use to determine trade entries and exits. Each week I am going to analyze fundamentals, sentiment and technical positions in order to determine which currency pairs are most likely to produce the easiest and most profitable trading opportunities over the next week. In some cases it will be trading the trend. In other cases it will be trading support and resistance levels during more ranging markets.

Big Picture 13th December 2015

Last week I highlighted short GBP/USD as a probable good trade trades. In fact all of the pairs I highlighted last week moved in the opposite directions to the longer-term trends, including GBP/USD. I did write that the Euro and Swiss Franc might well hold up and that is in fact what happened this week. It has been more of a case of renewed strength in the European currencies than renewed weakness in the USD.

This week I see the best opportunity as long USD/CAD. It is in a very strong bullish trend and has continued to make new 11 year highs. This week will be dominated by the FOMC Statement scheduled towards the end of this Wednesday’s New York session. There is a market consensus that the Fed will raise US interest rates that day by 0.25%. If they do, a continued upwards move in USD/CAD is quite probable. If the Fed unexpectedly passes on the cut, it will probably produce a rise in EUR/USD and GBP/USD.

Fundamental Analysis & Market Sentiment

The strong currency is the USD. The fundamental data could be stronger, however there have been no bad surprises. The position technically for the USD also looks strong. The currency is now trading higher than it was 3 months ago against every major global currency, with the exception of the NZD and AUD.

Weaker currencies are a little less clear but there is one that stand outs: the CAD.

Canadian fundamentals are poor and the price of oil, with which the currency is very highly positively correlated, has fallen to new multi-year lows. Although there has been something of a recovery in recent economic data releases, the economic picture going forward is far from rosy. The Bank of Canada recently stated that it would theoretically consider negative real interest rates should another financial crisis arise, which probably contributed to the latest round of weakening of the currency.

Technical Analysis

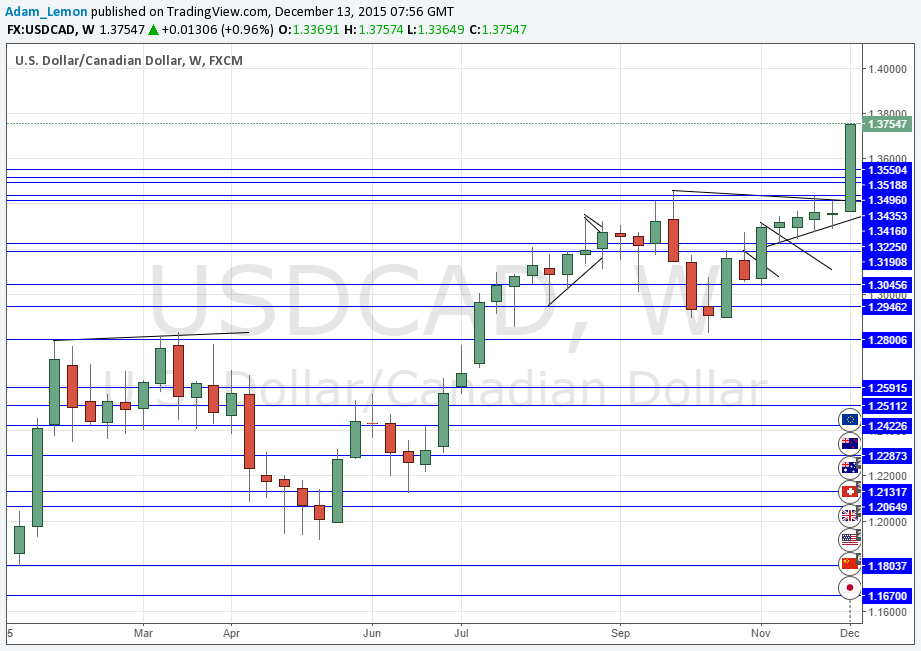

USD/CAD

The price action looks extremely bullish, with a very strong move up over this past week to reach new 11 year highs. There is no obvious resistance before the key round number of 1.4000, which was a key swing and monthly high in May 2004.

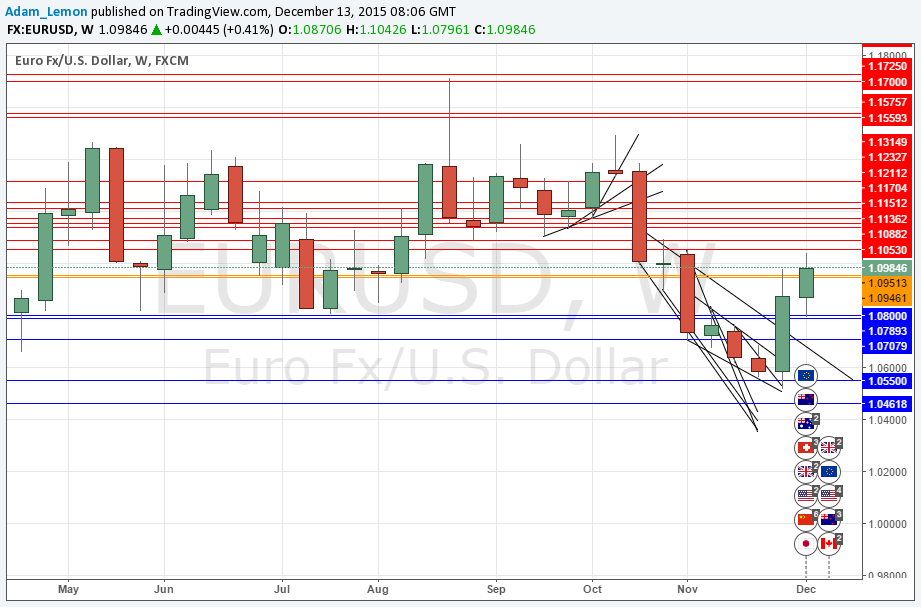

EUR/USD

This pair has risen strongly over the past two weeks, with the sharp move up following the ECB’s announcement on QE holding. However we are starting to reach the bottom of the previous range at around 1.1000 / 1.1100 which will probably provide resistance and chop. Nevertheless momentum has been strong here so any disappointment from the Federal Reserve could make an impact here on the long side.

The safest trade of the week is probably long USD/CAD.