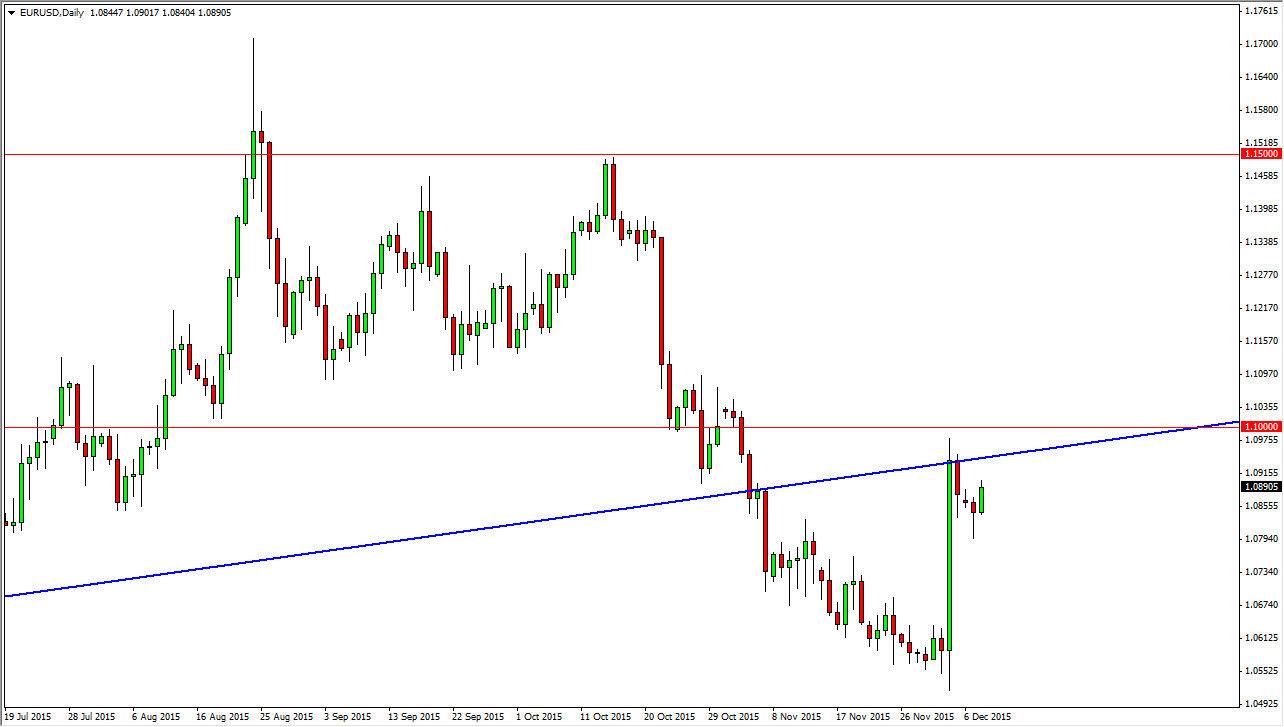

The EUR/USD pair rose during the course of the day on Tuesday, breaking the top of the hammer that had formed on Monday. This is a very bullish sign, and could give us a few hands as to where this market will at least want to go at this point in time. However, we do have quite a bit of noise above and as a result it’s difficult to imagine that the markets will simply shoot straight higher.

Looking at this chart, the uptrend line suggests that there could be resistance just above as it had been so supportive in the past. On top of that, the 1.10 level above is a large, round, psychologically significant number, and as such more than likely cause a bit of a reaction in the markets. Because of this, even though this market looks like it is starting to pick up momentum to the upside again, I am not pressed to start buying quite yet.

Potential Whiplash

I believe that there is serious potential for whiplash between the 1.08 level on the bottom, and the 1.10 level on the top. This is because there are so many reasons to think that this market will find a lot of volatility in this area and the market could be tight because of this. Once we break out above the 1.10 level, and more importantly the 1.11 handle, I think that the market would be free to start reaching towards the 1.14 level again. Between here and there, there are a lot of things that could go wrong if you find yourself long of this market.

On the other hand, if we break down below the bottom of the hammer, I think at that point in time we will continue to see bearish pressure and as a result the market could very easily reach back towards the 1.06 level again, which of course was the most recent low. Until we break out of this 200 pip range, I am on the sidelines.