During the session on Tuesday, the EUR/USD pair fell significantly during the course of the session on Tuesday, as the 1.10 level continues to offer resistance. However, today we have the FOMC Statement coming out, and as a result it’s very likely that we will get quite a bit of volatility in this market today. The market should continue to be one that is the focus of Forex traders, simply because the Federal Reserve is likely to move the markets today.

The Federal Reserve will have an interest rate announcement today as well, although the market has probably already priced in a one-time hike. It’s the statement the people will be paying the most attention to because it will give us an idea as to whether or not the Federal Reserve continues along the path of rate hikes or not. With that being said, this market probably going to be fairly quiet until we get that announcement.

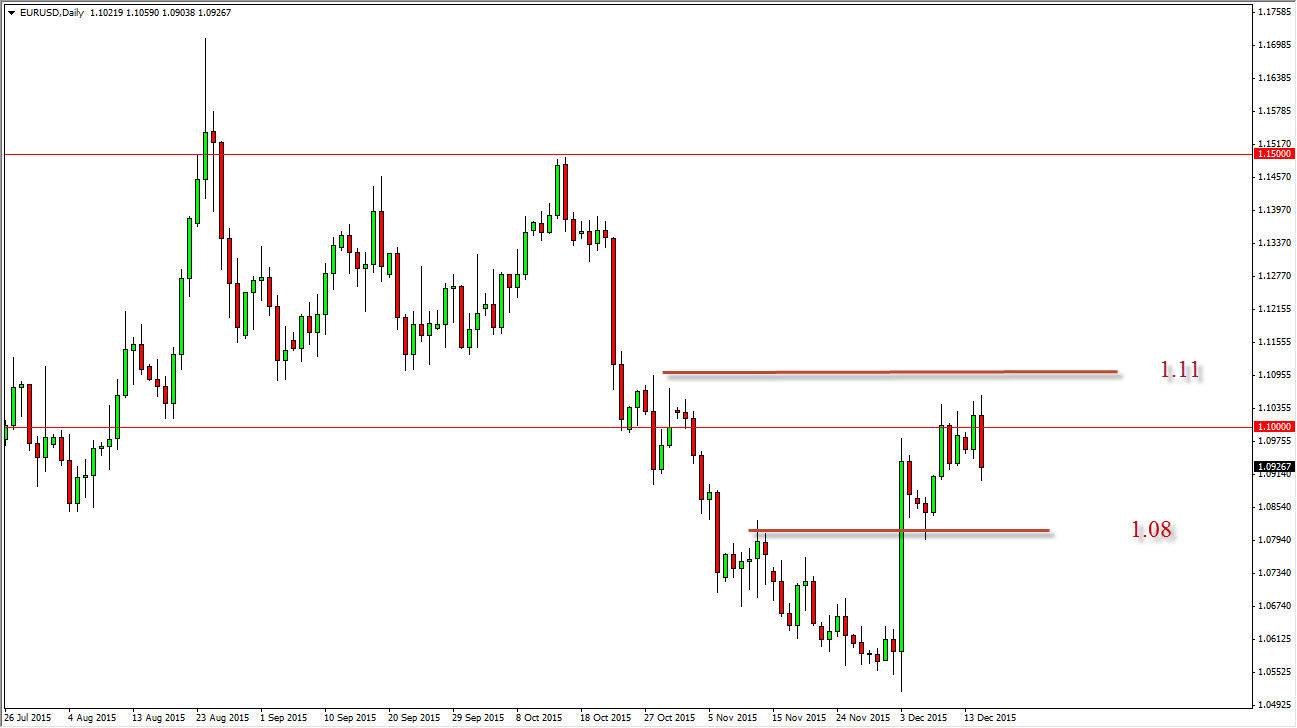

The Trading Range

The trading range at the moment is between the 1.08 level on the bottom, and the 1.11 level on the top. I believe that once we break out of this area, the market will have made its decision. I believe that a break down below the 1.08 level sends this market looking for the 1.05 handle given enough time, but on the other hand if we break out to the upside, the market will then reach towards the 1.14 handle. In the meantime, it’s going to be very volatile and a lot of noise just as it has been for some time now.

I think that waiting until the daily candle closes will more than likely be the best way to go, as liquidity will be a bit of an issue as well, as a lot of the larger players will stand back and wait to see what the market decides. I’m not going to worry about it though, because quite frankly any move at this point in time will probably be for a longer-term type of trade.