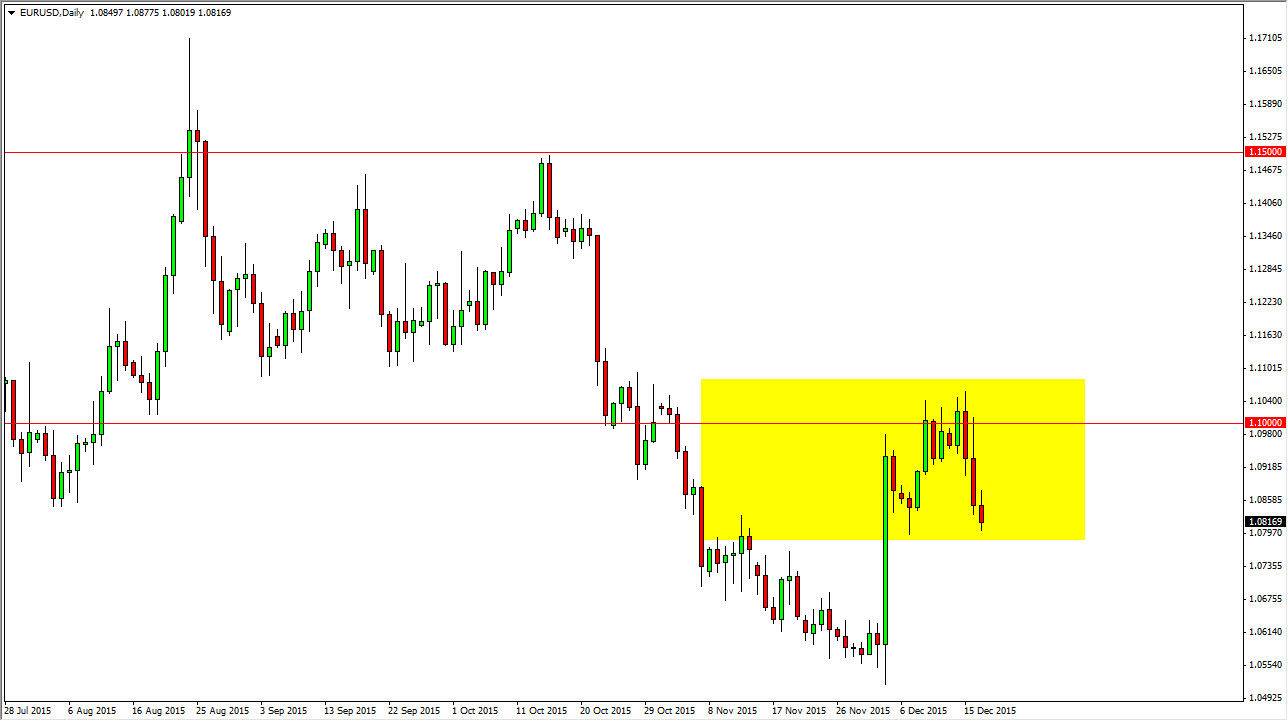

The EUR/USD pair initially tried to rally during the session on Thursday but then turned back around and fell to the 1.08 level. This is the bottom of the larger consolidation area as you can see marked on the chart, so at this point in time I think that it’s only a matter of time before we have to make some type of decision. If we get a supportive candle at the 1.08 level, I would be willing to start buying the Euro again. On the other hand, if we break down below the bottom of the 1.08 level, I feel that the market can be sold.

During this time of year, volatility and of course volume become problems. Because of this, I’m going to wait until we get some type of daily close either above or below the 1.08 level in order to make a decision. The daily candle will be used to make a decision going forward, and with that I feel it’s only a matter of time before he can place a trade, but I will be very cautious.

Consolidation

The question now is whether or not we can get some kind of clean break either way. Nonetheless, I find it interesting that the US dollar has strengthened against the Euro after the initial reaction higher. After all, the interest-rate announcement was received relatively calmly, and as a result it makes sense that we will continue to grind and therefore not break down or bounce with some type of massive momentum.

Ultimately though, it’ll be interesting see how the US dollar pans out against the Euro as we have seen quite a bit of volatility over the last several months. At this time of the year though, I would not put too much faith into any particular move for any real length of time, just simply because as liquidity dries out, the markets will move rapidly and then a more over exaggerated manner.