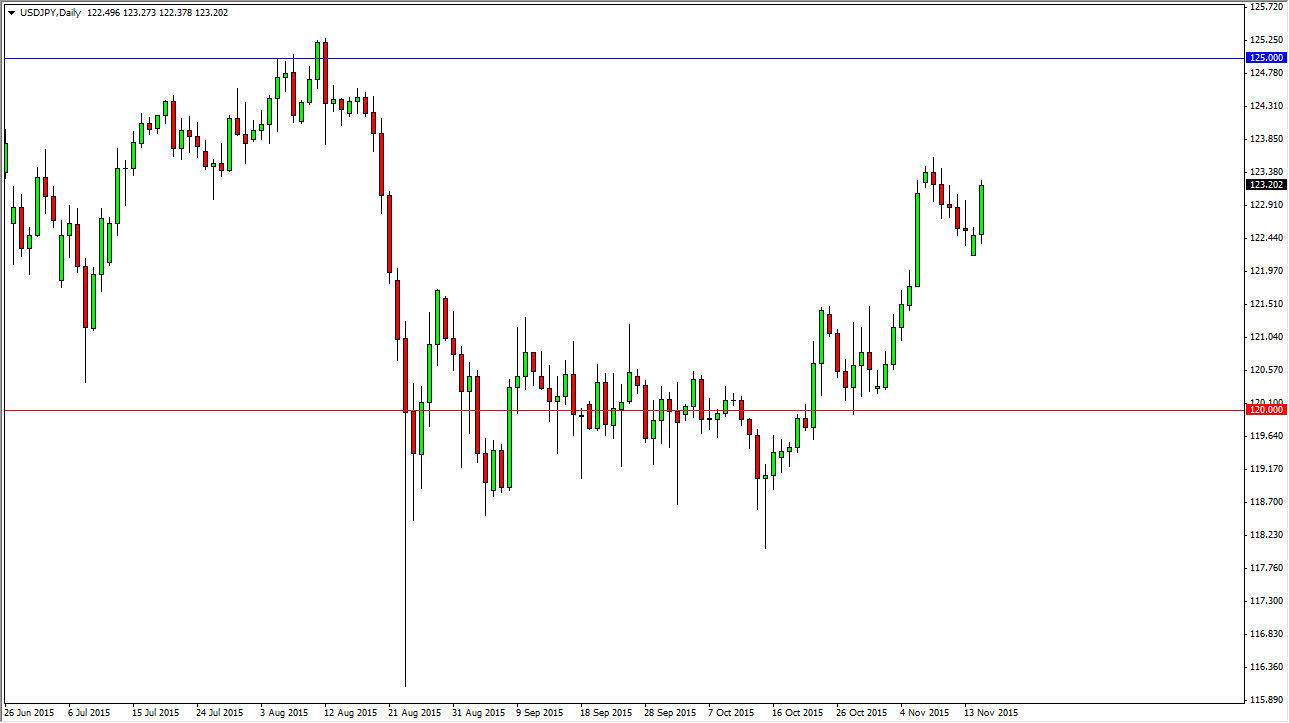

The USD/JPY pair broke higher during the course of the day on Monday, after initially gapping lower. Because of this, it appears that the momentum has shifted back in favor of the US dollar again, as the recent breakout has now somewhat confirmed itself. After all, we had been consolidating between the 118.50 level on the bottom, and the 122 level on the top. We have pulled back to test the 122 level for support now, and it has certainly shown itself to be reliable. With this, I feel that this market will eventually go higher, and I believe a break of the Monday session high is reason enough to start buying. Quite frankly though, I’m willing to buy this pair on short-term pullbacks as I believe the US dollar will continue to gain momentum overall, and of course against the Japanese yen is almost a no-brainer at this point.

Bank of Japan

The Bank of Japan continues to discuss possible expansion of quantitative easing, and of course stimulus, so that means that the interest-rate differential should continue to expand between these 2 currencies. I believe that this market is reaching towards the 125 handle, which was a massive resistance barrier at the beginning of August.

The 125 level will be difficult to break above, but eventually we should be able to do so. I think that it may take several pullbacks in order to build up the momentum necessary, but without a doubt this is a bit of a one-way trade at this point. I think that the 122 level should now offer a bit of a floor, and now that we have in fact shown the 122 level to be pretty reliable, I feel that it’s only a matter of time before buyers enter the market and finally gain the momentum needed.

A move above the aforementioned 125 level sends this market looking for the 130 handle next, with a bit of resistance to be found at the 128 handle. I have no interest whatsoever in selling.