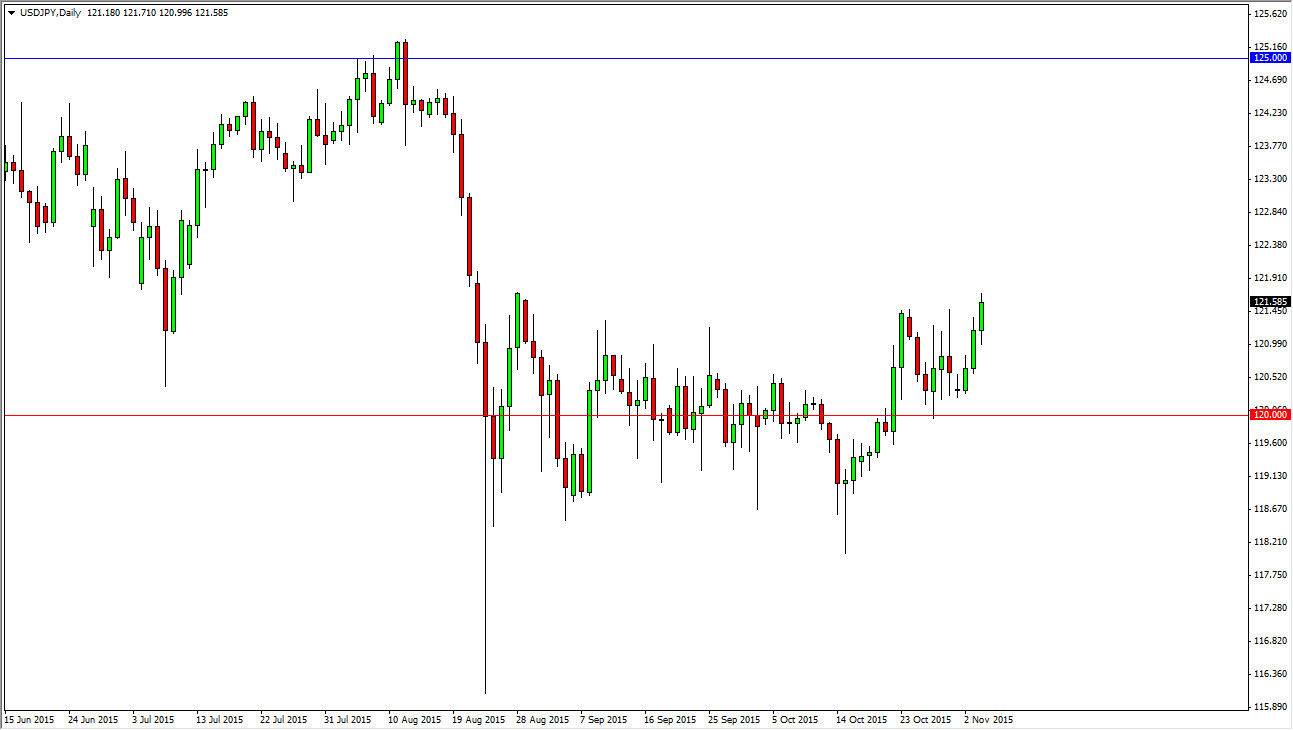

The USD/JPY pair initially fell during the course of the session on Wednesday, but found enough support near the 121 level to turn things back around and tried to break out. Breaking out from here would of course be a very bullish sign, and as a result we feel that the market should then reach towards the 125 handle. If we break out above the top of the range for the session on Wednesday, the market should eventually go higher, offering plenty of buying opportunities on dips as we go along.

Pullbacks at this point in time should find plenty of buyers all the way down to at least the 120 handle, so I essentially have this is a “buy only” type of situation. With that being said though, Friday of course is huge for this pair as the Nonfarm Payroll Numbers have a great influence on where this pair goes next.

Nonfarm Payroll Friday

Because Friday is the jobs number out of the United States, I believe that this market is trying to show what it wants to do ahead of time. With that being the case, the market should continue to show a bit of volatility, and could in fact fall rather rapidly during the session on Friday, but ultimately I believe that we are already seeing what the market wants to do and therefore it is giving its hands as it tends to do from time to time.

Having said that though, you have to keep in mind that the central banks of both countries are getting the markets plenty to think about. After all, the Federal Reserve stepped away from rate hikes, and that of course puts a little bit of pressure on the US dollar. On the other hand though, the Bank of Japan most certainly is stepping away from anything close to rate hikes, and should continue to add quantitative easing going forward. With this, I think that the pair goes higher, it just isn’t going to go higher as quickly as it once did.