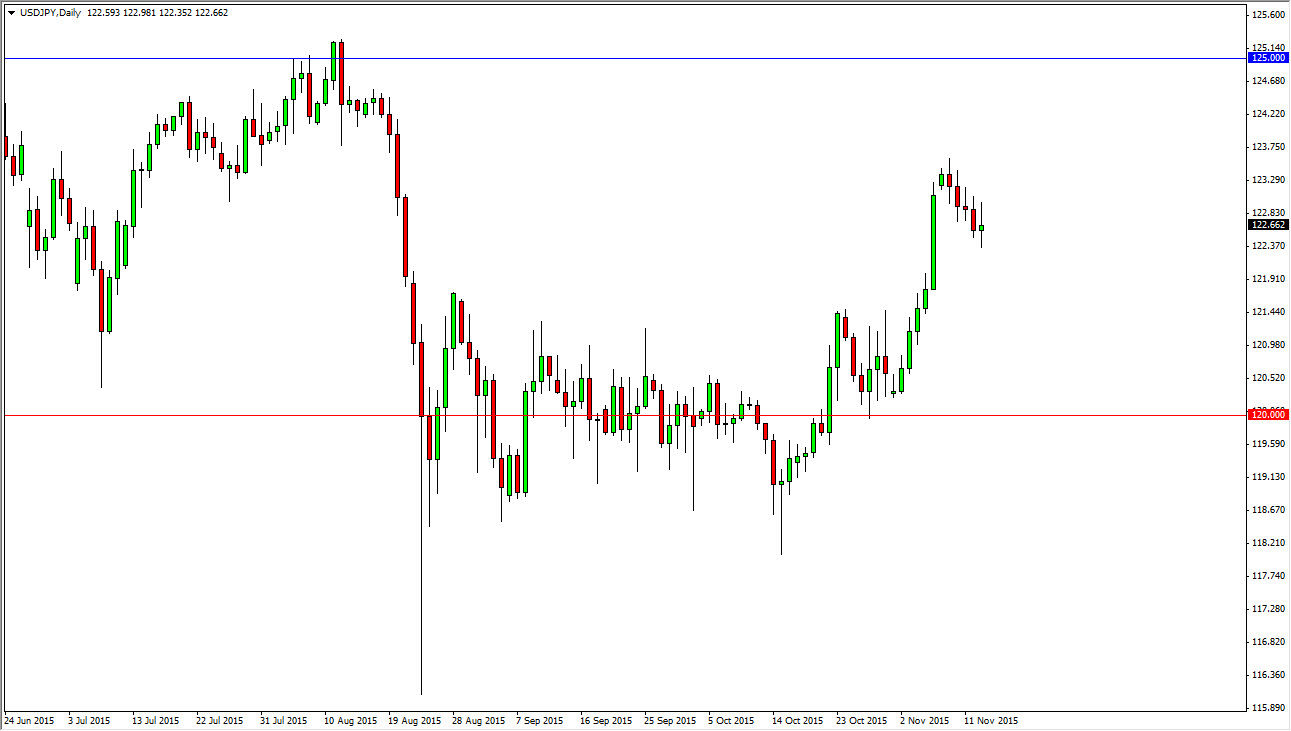

The USD/JPY pair went back and forth during the course of the day on Friday, showing a neutral candle, and a bit of interest in the 122.50 level. Ultimately, this market should go higher as far as I can see, and I have no interest in selling this market. I believe that the 122 level below is massively supportive, based mainly upon the fact that the 122 level was the top of the consolidation area that the market had been bouncing around in. Now that we broke above the top of that consolidation rectangle, it means that the market should continue to go much higher and that the 122 level should offer support. After all, one of the basic tenets of technical analysis is “what was once the ceiling now becomes the floor.” Ultimately, this market should start reaching towards the resistance barrier at the 125 handle.

125 Matters

We have to get above 125 in order for the market to continue the longer-term uptrend, as the level offered quite a bit of resistance the last time we went that high. However, it appears that with the better than expected jobs number coming out of the United States, the Federal Reserve will have to raise interest rates sooner rather than later. The Bank of Japan on the other hand of course has no interest in raising interest rates, and are probably light years away from doing so. In fact, they will more than likely add stimulus to the economy, and as a result it makes sense for this market continues to go higher as the interest-rate differentials between the two currencies continue to widen.

At this point in time, it is more than likely that the market will continue to offer buying pressure over time it pulls back, and as a result this is a “long only” type of situation going forward as the us dollar is one of the more preferred currencies in the world at the moment.