USD/CHF Signal Update

Last Thursday’s signals were not triggered and expired.

Today’s USD/CHF Signals

Risk 0.75% per trade.

Trades may only be taken before 5pm London time today.

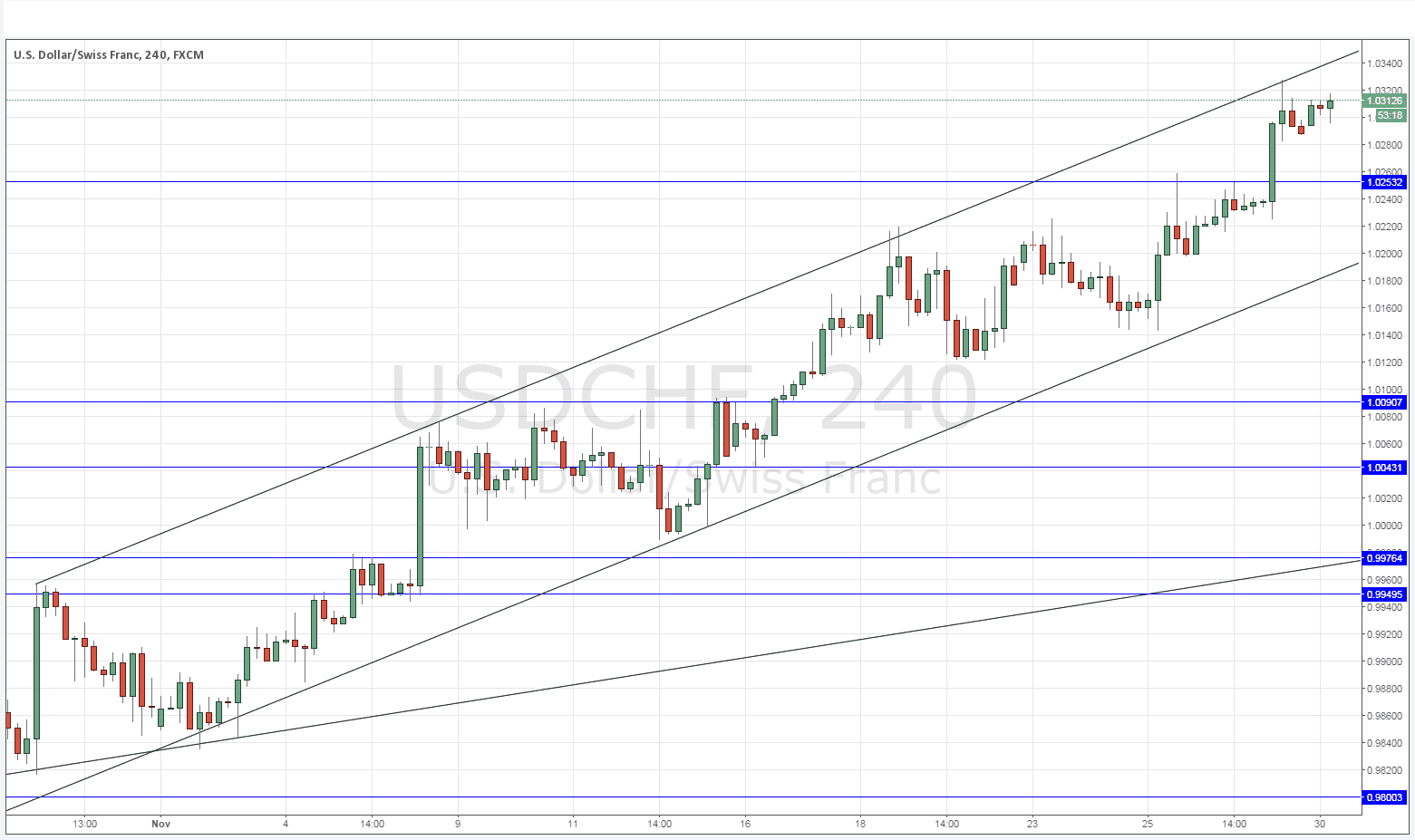

Long Trade 1

* Long entry after bullish price action on the H1 time frame following a touch of 1.0253.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Long entry after bullish price action on the H1 time frame following a touch of the lower channel trend line currently sitting at around 1.0192.

* Place the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

USD/CHF Analysis

This pair was contained last Thursday by the key psychological number of 1.0250, but was able to break up past it on Friday, making another 5 year high. The price has pulled back a little since then, but not by very much, and is holding up well.

The chart below shows that there is a fairly long-term, symmetrical bullish channel that is holding the price. Touches of the bottom of the channel or of 1.0192 below the channel should be excellent opportunities to enter long positions.

There is not really any obvious resistance above, we are trading in blue sky, so I would not be seeking any short trades at the moment.

There is nothing due today regarding the CHF or the USD.