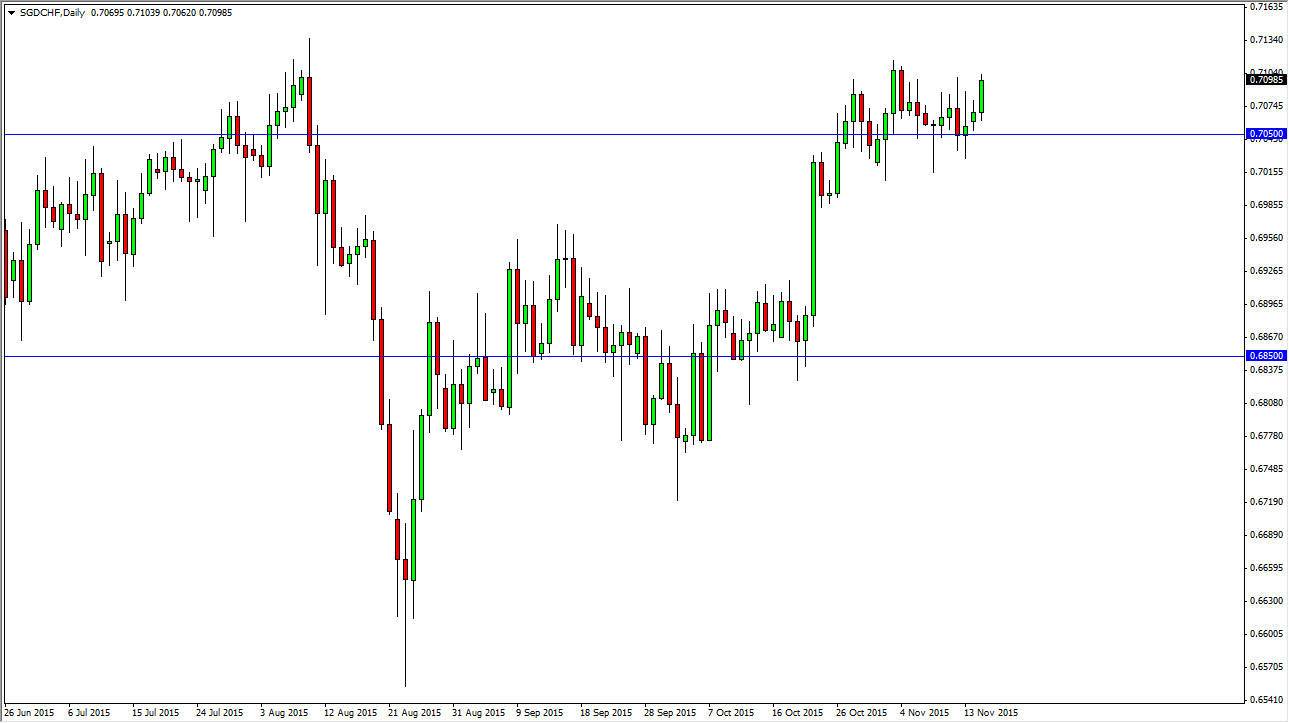

The SGD/CHF pair has been consolidating for some time now, as the 0.70 level has offered support time and time again. The market has resistance at the 0.71 level as well, so having said that the market looks as if it is ready to go higher eventually, so I think that short-term pullbacks will continue to offer buying opportunities on short-term charts. I think that the support has been rather reliable and steady, so I feel that this market eventually breaks out to the upside. At this point in time, short-term traders will continue to make money to the upside, while a long-term trader that is patient enough to wait for break out above the 0.71 level will make quite a bit of money to the upside.

Safety Currencies

Both of these are considered to be safety currencies, as the Singapore dollar is one that is used for quite a bit of thinking in Asia. That of course means that it is considered to be “reliable”, while the Swiss franc of course has been thought of as a safe haven for quite some time. However, one of the things that makes this pair different than it normally is would be the fact that it appears that we have an “Asia versus Europe” type of feel.

In other words, I believe that this chart is expressing the fact that people are much more comfortable in Asian markets than they are Europe at the moment. That’s a bit unusual, but quite frankly if you think of everything that has been going on in the European Union for some time now, it’s not that big of a stretch. I believe that it is only a matter of time before we pick up the momentum and break above the 0.71 level, and then reach towards the 0.75 handle. Keep in mind that this pair does tend to chop around the bed, and then have a sudden and impulsive moves. With this, you will have to be patient.