The NZD/CHF pair of course is one that a lot of you want pay attention to, when you look at the 2 currencies, they are both majors. With this, you have to keep in mind that it is a market that’s available and has a decent spread, and on top of that can be used in different ways. If there is New Zealand dollar strength in general, that normally is a buying opportunity, as the New Zealand dollar is completely contradictory as to what the Swiss franc stands for. After all, the New Zealand dollar is highly influenced by commodities, while the Swiss franc is typically thought of as a safety currency. With that being said, I find this chart very interesting at the moment as it suggests that perhaps we are entering a “risk on” type of situation over the next several sessions, or even longer than that.

Risk on

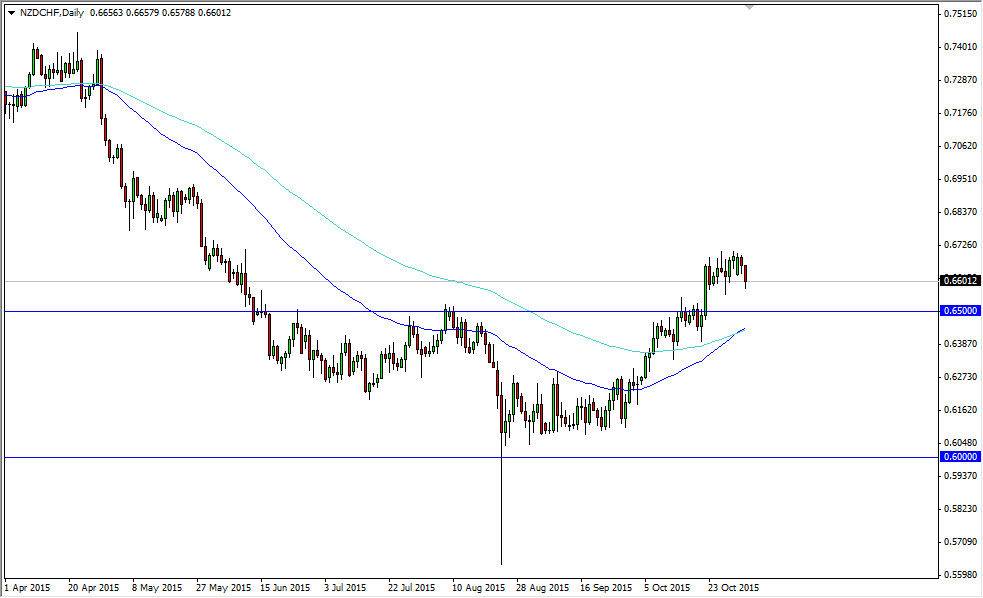

I find it also very interesting that the US stock markets are starting to show signs of breaking out to new legs higher, and that of course could be a defining act as well. On the attached chart, you can see that we continue to consolidate somewhere around the 0.66 level, which see support all the way down to the 0.65 handle. We’ve essentially broken out to the upside and pulled back in order to try to build up momentum so we can continue to go much higher.

You can see that I have 2 exponential moving averages on this chart, the 50 and the 100 day. We are now starting to see the 50 day exponential moving average crossover the hundred day exponential moving average, and that of course is another sign of a trend change. With this in mind, I feel that we are going to see continued strength in this pair, and pullbacks should continue to be nice buying opportunities. I see no reason why we won’t reach out towards the 0.70 handle, but it might take a little while to get there.