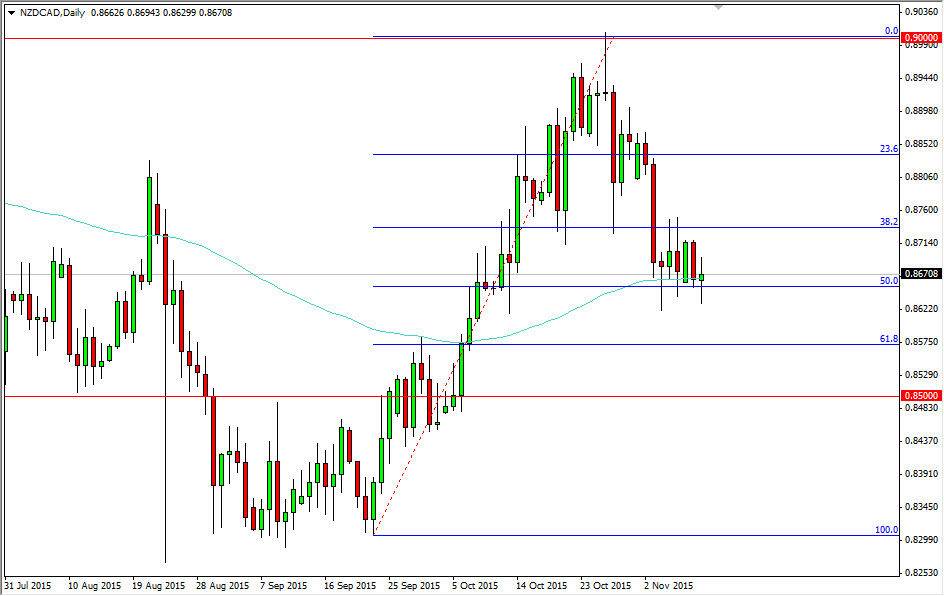

The NZD/CAD pair went back and forth during the day on Tuesday as we continue to find support near the 0.8650 handle. This is a market that of course features a couple of commodity currencies, and with that we will have conflicting momentum in both directions. After all, the New Zealand dollar is very sensitive to the overall attitude of commodity markets, while the Canadian dollar is very sensitive to the crude oil markets specifically.

At the end of the day though, what I’m looking at is the fact that we have been grinding away in this general vicinity, and it appears that the market is continuing to find quite a bit of support based upon the 100 day exponential moving average. On top of that, we have the 50% Fibonacci retracement level in that same general vicinity. I believe that this market is going to go higher, but keep in mind that both of these currencies are a bit soft at the moment, so I believe that it is going to be more or less a grind higher, and as a result you will have to be patient.

Pullback

I believe that the pullback has served its purpose, and we are now support trying to build up enough momentum to go higher. The Canadian dollar itself is struggling, and as a result I think the New Zealand dollar will perform slightly better. With that, it’s enough to push this market higher. I think that the market will reach towards the 0.90 level as it did previously, and that is my longer-term target.

If we break down below here, there should be a massive amount of support near the 0.8550 handle, which is essentially the 61.8 Fibonacci retracement level. Ultimately, I think that there are more than enough reasons to think that this market will continue to go higher over the longer term.