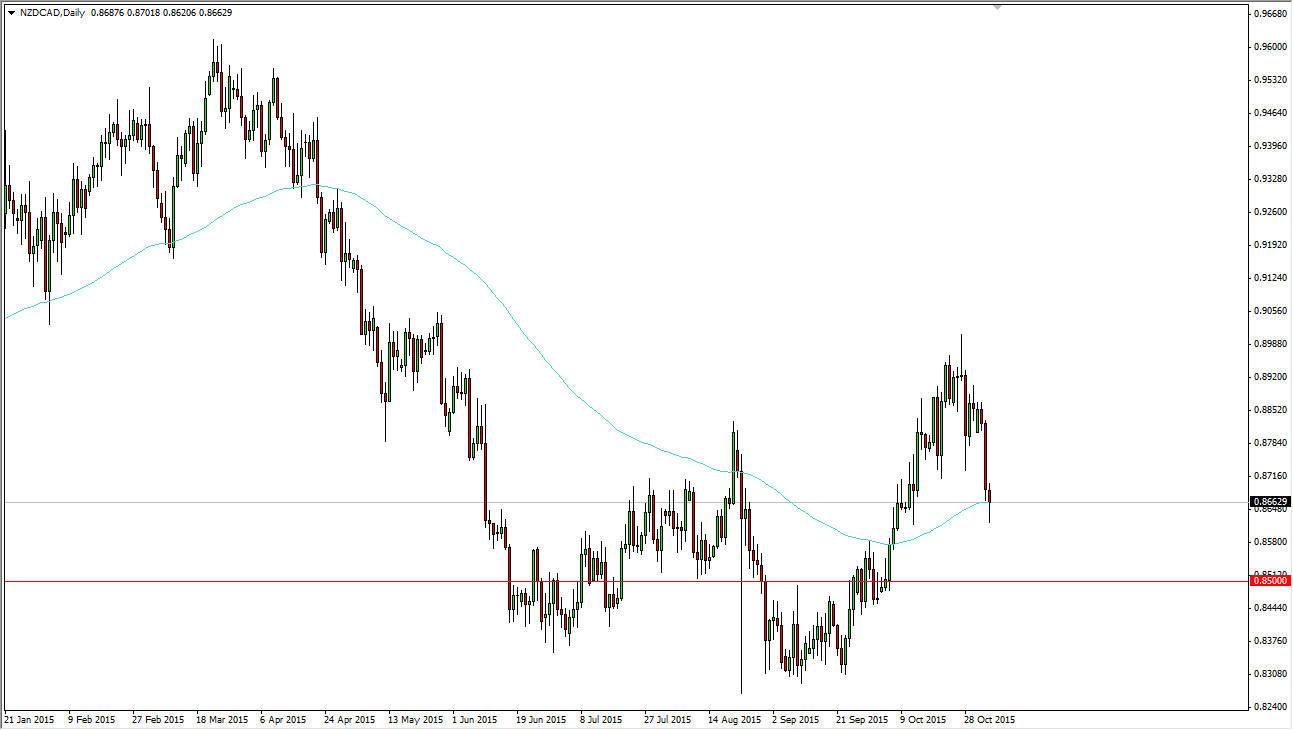

The NZD/CAD pair initially fell during the course of the day on Wednesday, but found enough support near the 0.86 level to turn things back around and form a hammer. On top of that, we have the 100 day exponential moving average at this level, and the fact that a hammer has coincided with that particular level has me thinking that this market is ready to go much higher. If we can break above the top of the hammer, I am a buyer as the market should then reach towards the 0.850 level next.

This is an interesting market though, because it features to commodity currencies. Commodity currencies in general are going to suffer but it appears that perhaps Canada is going to suffer more than New Zealand. Ultimately, the fact that the US dollar broke the top of a shooting star against the Canadian dollar suggests that the Canadian dollar is in real trouble.

Longer-term play

I believe that the market going higher is probably going to be more or less a long-term move, and as a result you will have to deal with significant amounts of volatility and of course hang onto the trade through various pullbacks. Once we get above the 0.90 level though, at that point in time the market should continue to go much higher, perhaps reaching towards the 0.96 level.

On the other hand though, if we did break down below the bottom of the hammer, that would be very negative, and as a result I believe at that point in time the market would reach towards the 0.85 level which of course is a large, round, psychologically significant number. That area is of course important, but you have to keep in mind that the most recent high was higher than the previous one, so now we have to find the next low. If this low is higher than the previous one, and it does look like it’s going to be, we could very well be seeing the trend change before very eyes.