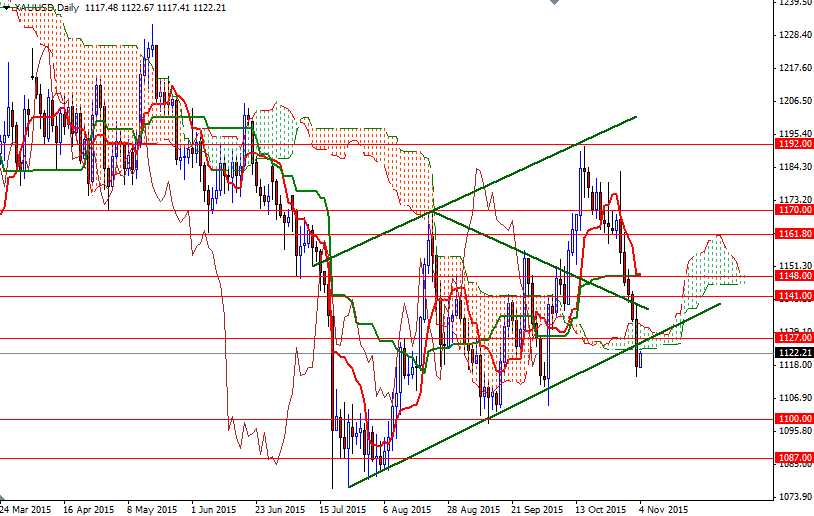

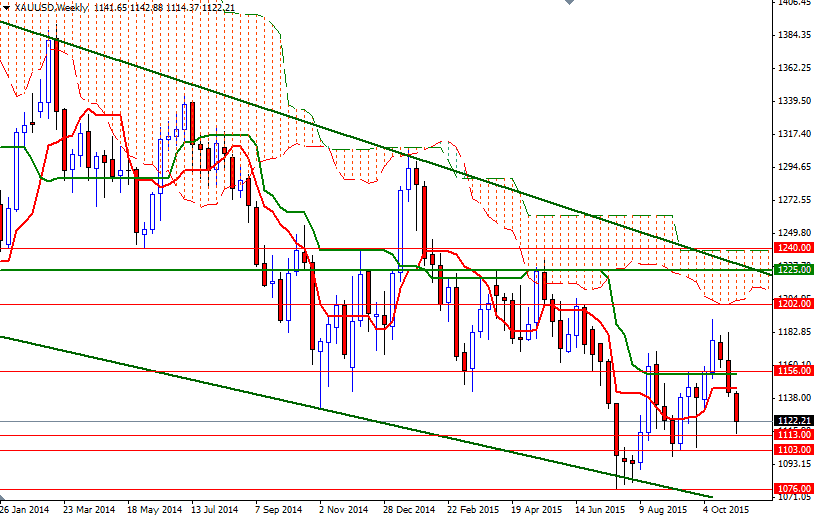

Gold prices fell for a fifth straight session on Tuesday and settled at $1117.57 an ounce, weighed down by the strength in the greenback and U.S. equities. As expected the daily Ichimoku cloud did provide support yesterday (and pushed prices towards the 1141 resistance) but we eventually dropped through this area. Not surprisingly, breaking below the cloud accelerated the downward movement and dragged the XAU/USD pair to the next significant support, around the 1113 level.

Apparently concerns about the Fed raising rates, along with the perception that stock markets remain more attractive, are going to keep gold under pressure until the next FOMC meeting. However, trading may be volatile ahead of the October jobs report, due on Friday. The XAU/USD pair is currently trading at 1122.21 but the move up from 1114 may be limited as the daily Ichimoku cloud stays right on top of us.

The pair has to push its way through the 1127 resistance level -which also happens to be the 4-hourly Tenkan-sen (nine-period moving average, red line)- level in order to revisit the 1133/1 region. Beyond that, the bears will be waiting in the 1141/38.50 area. If XAU/USD fails to penetrate the daily cloud and sellers return, we will probably head back to the 1113/0 support. A close below 1110 would suggest that a bullish reaction may have to wait a little longer as the bears will be aiming for 1103/0.