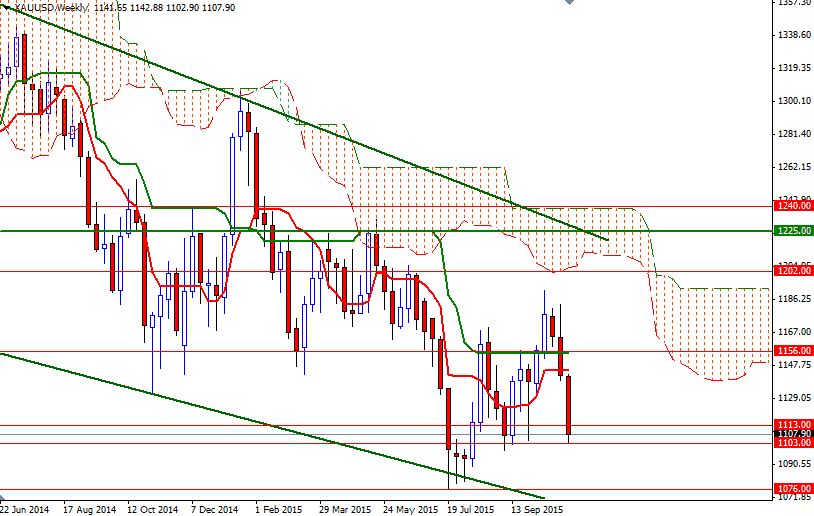

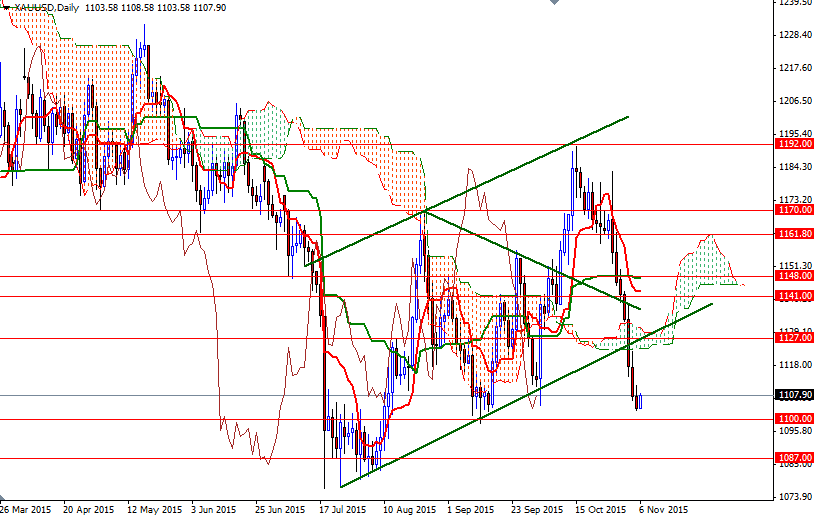

Gold prices declined for a seventh straight session on Thursday to settle at their lowest level since mid-September as the prospect of a December rate hike by the Federal Reserve continued to depress the demand for the precious metal. The XAU/SD pair initially traded as high as $1111.42 an ounce yesterday but couldn't gather enough momentum to penetrate the resistance in the 1113/0 area and consequently headed lower and tested the 1103 support as expected.

The market has been under significant amount of pressure since fresh signals by the U.S. central bank fueled expectations that policy makers will consider altering monetary policy in December. However, the timing of the first move is data dependent and because of that the official monthly jobs report will draw more attention than usual. XAU/USD just bounced off a key support level at 1103 and it looks like we are heading up to the 1113/0 region.

We will probably have to wait for the release of the NFP data before price get anywhere interesting. The intra-day key levels all remain the same as yesterday as the market remained within a relatively tight range. While a break up above 1113 could see a pull-back going all the way up to 1123 or 1127, eliminating the 1103/0 support would open up the risk of a move towards 1096 and a retest of 1093. If the bulls manage to break through 1127, the next stop will probably be the 1131 level - the top of the daily Ichimoku cloud. Falling through 1093 on the other hand would imply that the 1089/6 support will be tested.