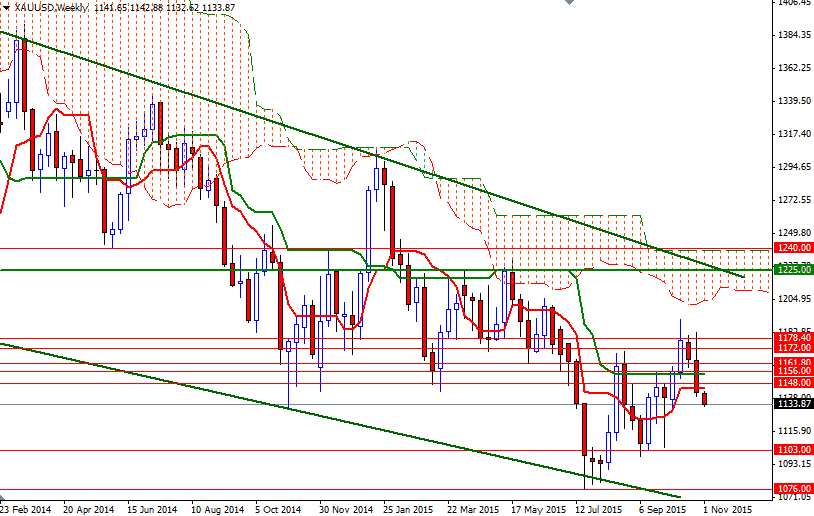

Gold prices ended Monday's session down 0.72% as demand for the greenback and technical selling continued to weigh on the market. The XAU/USD pair slumped to $1133.37, the lowest level October 5, after a breach of a key support at $1141 extended losses. Gold has come under renewed pressure in recent days, as market players recalibrated their outlook on U.S. monetary policy in light of recent statements from the U.S. Federal Reserve. Buoyant equities markets also contributed further pressure on gold.

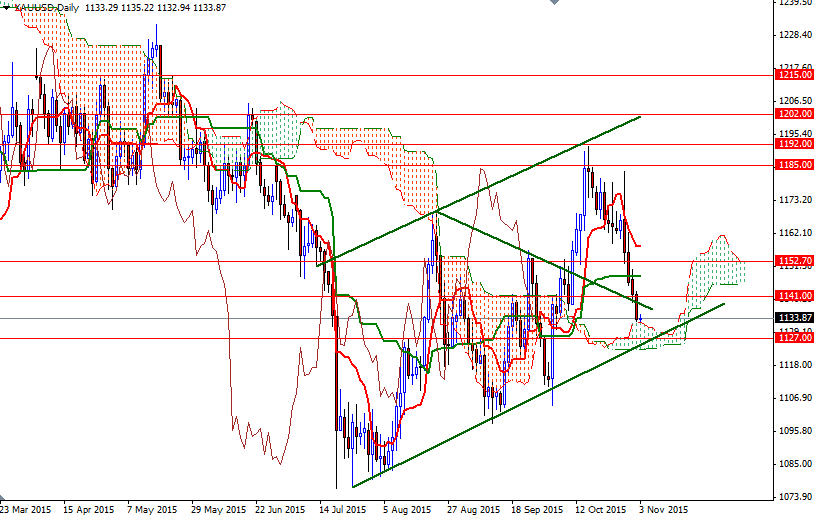

The XAU/USD pair is trading just above the daily Ichimoku cloud at 1133.87 in early Asian session. As I pointed out in my monthly analysis there is an anticipated support zone that stretches from 1131.95 to 1123.49 - the area occupied by the daily cloud. Since the lower trend-line of the ascending channel and a horizontal support (1127) converge in this particular area, we might see some short-side profit taking; i.e. a bounce towards the broken support at 1141.

If prices can anchor somewhere above 1141, it would be a sign of a bullish recovery. In that case, it would be technically possible to see the market heading back to 1152.70 - 1148 region where the daily Kijun-Sen (twenty six-period moving average, green line) resides. On the other hand, if the market can't create a temporary floor above the aforementioned support and prices fall through 1123.49, it is likely that XAU/USD will march towards 1113/0.