By:DailyForex.com

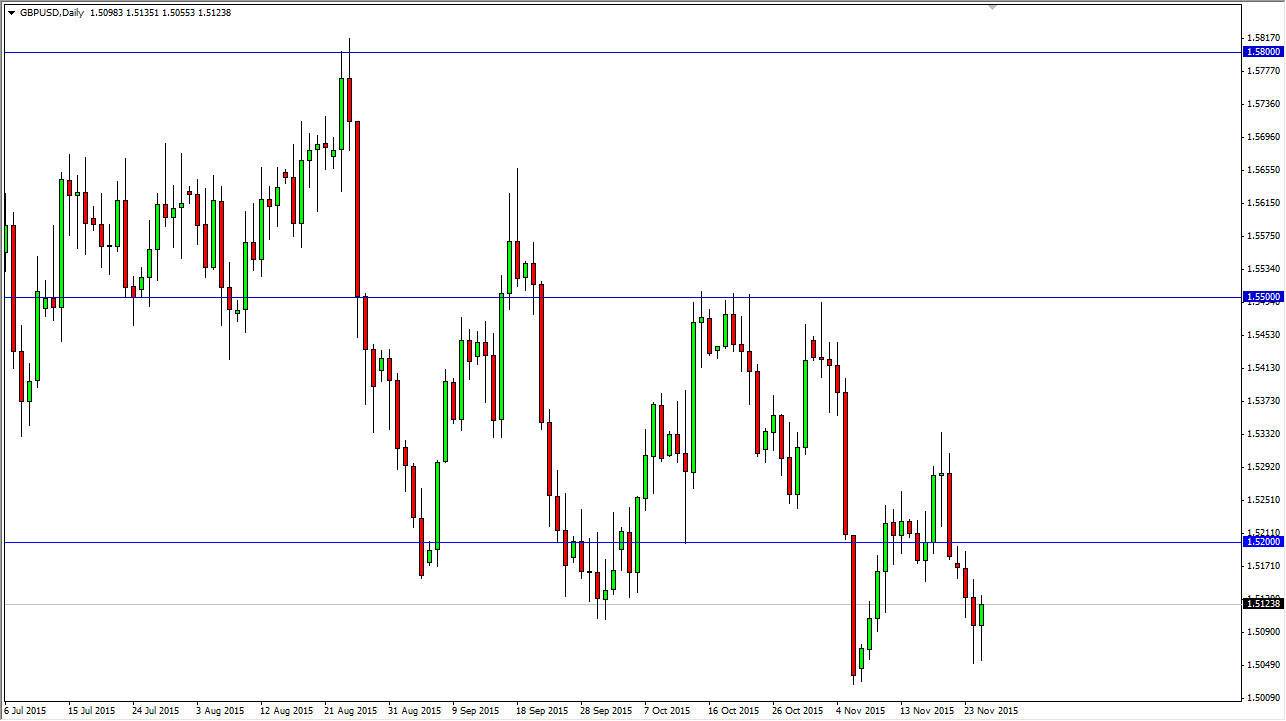

The GBP/USD pair initially fell on Wednesday, but found enough support near the 1.5050 level to turn things around and form a nice-looking hammer. This is an identical looking candle to the previous hammer from Tuesday, so it looks like a bounce is basically an imminent move.

However, I do recognize that there is a lot of resistance above, and the 1.52 level will be the first major resistance barrier that the market has to deal with. Above there, I think the 1.53 level will bring in sellers again as well. However, if we do bounce from here we have to recognize that it would be a slightly “higher lows”, and that could mean that the market is trying to find the bottom of the moment. I don’t know necessarily that’s what’s happening, as the US dollar is favored around the world, but it is an interesting thing to pay attention to.

Hey, At Least It’s Not the Euro.

There is the possibility that perhaps the British pound get a little bit of a bounce mainly because it’s not the Euro, which is generally the measuring stick of the Forex markets when it comes to the US dollar strength. I think that one thing you can count on is volatility, and with today being Thanksgiving Day in the United States we could get a little bit of a move. However, I think that ultimately you still have to feel much more comfortable selling this pair than buying it, as the US dollar looks very bullish against almost everything out there at the moment. It’s not only the Forex world, but the commodity world that looks very susceptible to the strength of the greenback at the moment. In other words, it’s about the only thing that people truly want to own.

This tells me that perhaps the bond markets could lead the way. Ultimately, most people prefer US treasuries over GILTS, although neither one of her necessarily considered “risky asset.” Things being equal though, as people prefer US bonds. This could be what keeps this market grinding a bit lower. A bounce from here is a necessarily a big surprise though, because the 1.50 level is of course psychologically significant.