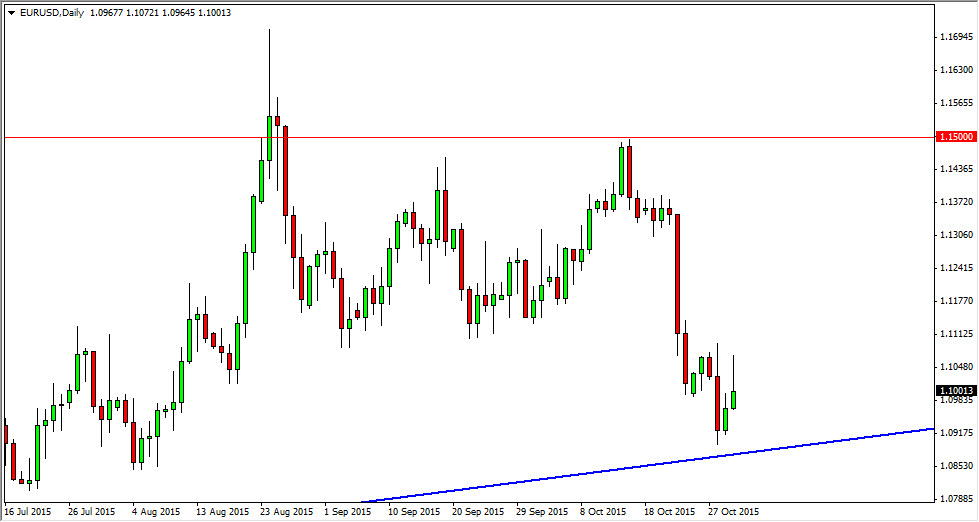

The EUR/USD pair rose during the course of the day on Friday testing the 1.11 level, but struggled to keep the gains that had formed. By doing so, we ended up forming a shooting star which of course is a negative candle. However, before we get too bearish on this market I would anticipate that the uptrend line below should continue to be very supportive. It is an uptrend line that formed based upon an ascending triangle from longer time periods. Because of this, I believe that there is real strength in this uptrend line, so it’s not until we get below there that I feel that the market should continue to go much lower. At that point in time, we would reach towards 1.08 level, and then possibly the 1.05 level as well.

Longer-term charts

Having said all of that, the longer-term charts, mainly the weekly time frame, looks as if the buyers may step back into this market. If we can break above the top of the hammer on the weekly chart, I feel that the market will then reach towards the 1.15 handle or so. If we can clear the 1.11 level cleanly, I feel at that point in time it’s time to start buying the Euro again. Keep in mind that there is a line of noise in this market for good reason, mainly because the central banks are doing everything they can to confuse it.

The European Central Bank has recently suggested that stimulus could be coming, and that of course is very negative for the Euro itself. At the same time, we have the Federal Reserve which is systematically changed the needs for rate increases over the last several years, and it appears that they are quite a way away from doing so. With that being the case, more than likely we will continue to see a lot of back and forth action in this market as there is no real clear direction either way.