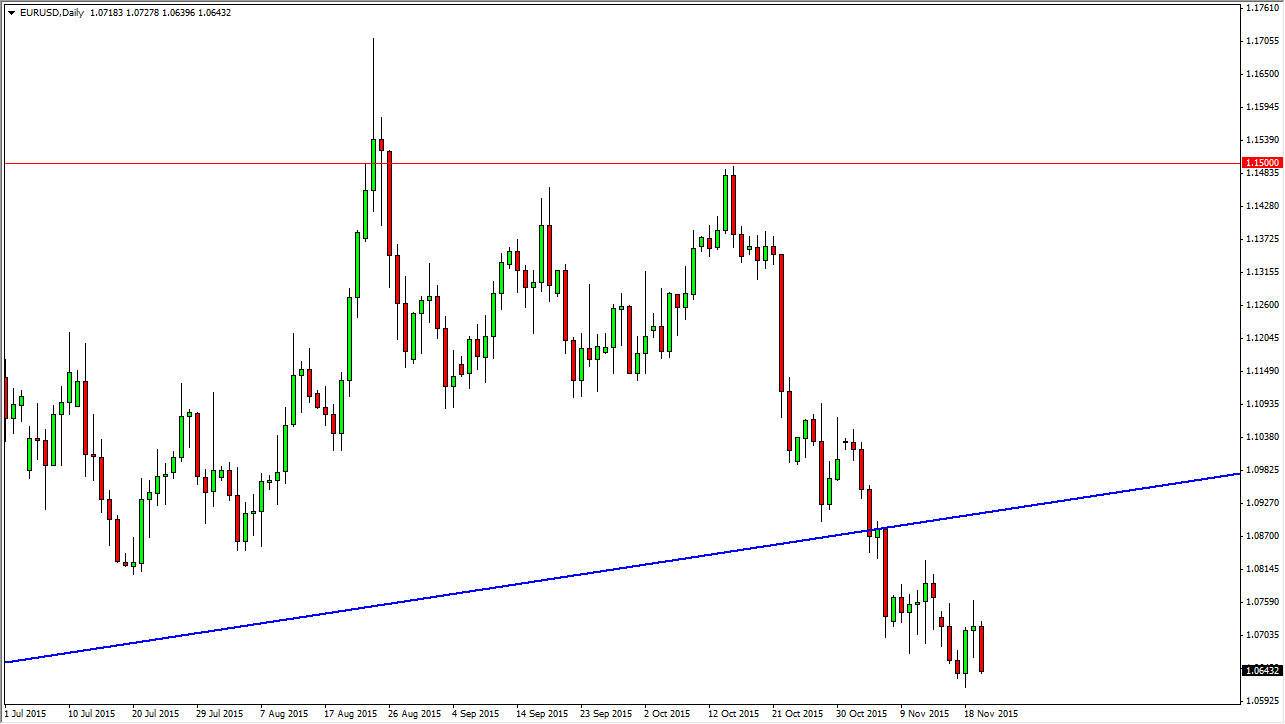

The EUR/USD pair fell during the course of the day on Friday, as we continue to press the downside in this market. The 1.0625 level below has been supportive more than once, and as a result I believe that this market will have a bit of a struggle going lower. However, I do think it happens given enough time. Quite frankly I would love to see some type of rally in order to sell the Euro as we continue to see negativity. After all, the uptrend line that had previously offered so much support previously would more than likely offer resistance at this point in time. After all, this is a market that had broken down below a rather significant ascending triangle. I believe that a resistive candle between here and there is an excellent selling opportunity as it offers “value” in the US dollar.

The 1.05 Level

The 1.05 level below is a large, round, psychologically significant number, and as a result the market looks as if it will more likely try to test that area again. This area could get broken below, and if it does I feel that the market then goes to the parity level. However, at this moment in time we are well oversold at this point in time, and as a result it more than likely could get a little bit of a reprieve due to that simple fact. However, we still have a complete divergence as both central banks are in opposite sides of the monetary policy corners.

The Federal Reserve may have to raise interest rates fairly soon due to the fact that the jobs number is much stronger than anticipated. With this, there will be quite a bit of pressure to raise interest rates in the near term, while the European Central Bank has suggested that perhaps more stimulus isn’t completely out of the question. With this, I think that the Euro continues to fall, and as long as we stay below the bottom of the uptrend line, I don’t see any reason to start buying.