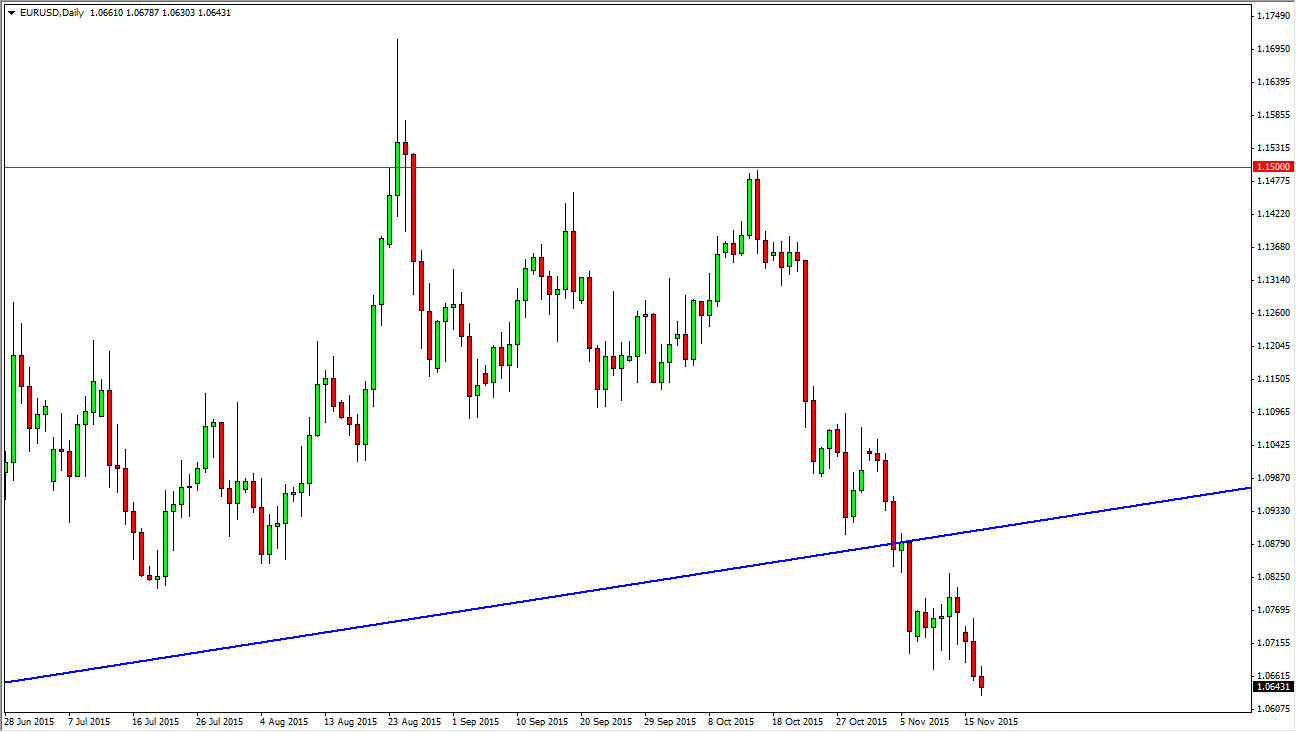

The EUR/USD pair fell again during the course of the day on Tuesday, as we continue to drive lower. We are well below the 1.07 level now, so it looks as if we are going to continue the downward pressure. I believe that once we broke below the uptrend line of the larger ascending triangle, this market had made up its mind that wanted to go to the 1.05 handle below. In fact, at this point in time that is my longer-term target.

I believe that rallies at this point in time will offer selling opportunities as the Euro simply cannot get out of its own way. Because of this, I have no interest in buying this pair, especially considering how strong the jobs number was out of America, which of course suggests that the Federal Reserve will have to raise interest rates. If they do, this is very positive for a currency.

European Central Bank

The European Central Bank recently stated that they were prepared to expand quantitative easing and stimulus measures, and that course spooked the Forex market. Because of this, I think that unless we get some type of complete change out of the Federal Reserve, more than likely the Forex market will continue to look negatively on this pair. In the FOMC Meeting Minutes coming out today, it’s likely that the volatility could enter this market again. That volatility will more than likely press this market to the downside.

On the other hand, if we do rally I think as long as we stay below the bottom of the uptrend line, there should be plenty of downward pressure and it would simply offer an opportunity to start shorting this market again. I think that the 1.05 level is much more likely to be tested than the 1.10 level over the course of the next couple of weeks, which is what it would take for me to feel comfortable buying this pair.