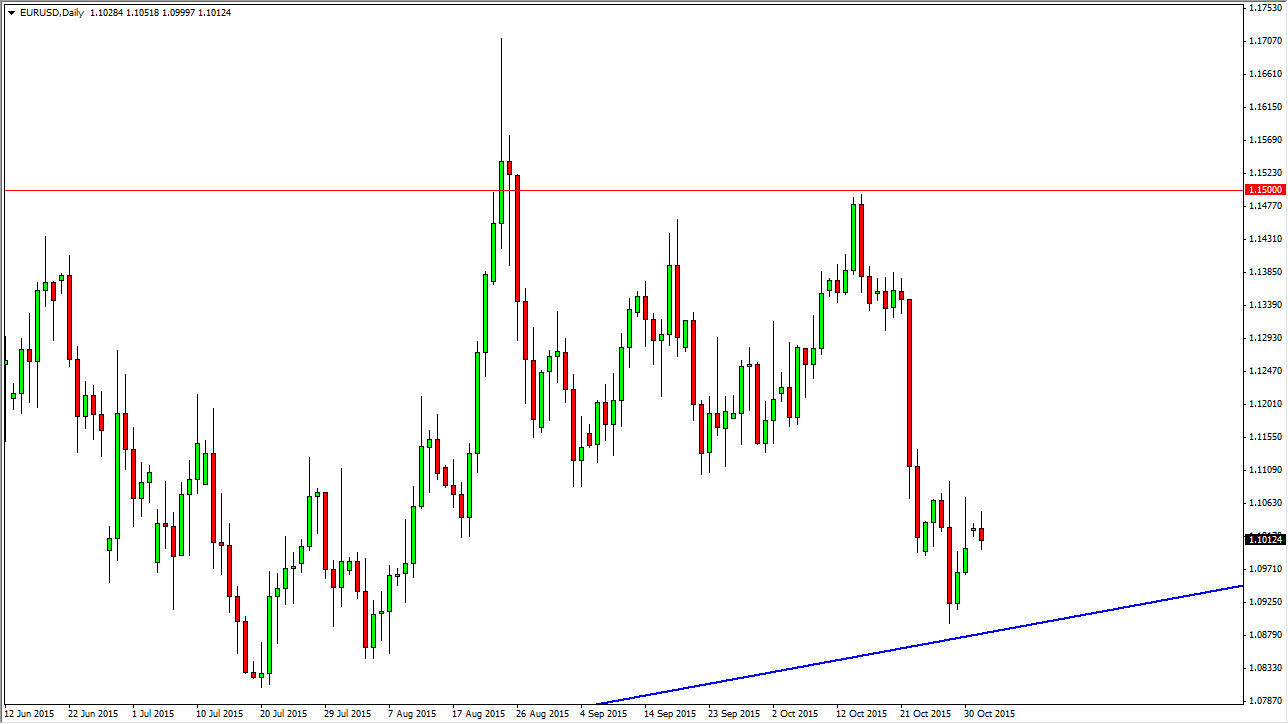

The EUR/USD pair initially gapped higher at the open on Monday, but had quite a bit of volatility that pushed the market lower. With that being the case, I believe that this market will drop a little bit during the session today, but I also recognize that the uptrend line below should continue to keep quite a bit of support for the Euro intact. After all, it is an uptrend line on a larger ascending triangle that of course has been quite important.

With this being said, I believe that short-term sellers may take control, but will certainly struggle to hang onto any selling position at this point in time. Ultimately, this market should find enough support below to keep this a fairly volatile couple of sessions coming out.

Don’t Forget About Nonfarm Payroll

I believe that with the Nonfarm Payroll numbers coming out on Friday, we are going to struggle to find any real direction for any real length of time at this point. However, I think this is setting up for a very important jobs number, as we have both central banks looking very dovish at the moment. Ultimately, I believe that the volatility will be a mainstay in this pair for the rest of the year, and therefore it remains a very difficult market to be involved in. I think only short-term traders will continue to have any real chance at making money, and with this you will have to focus on shorter time frames. At the moment, I see the 1.11 level as resistance, with the 1.09 level as support. The market should continue to bounce around in this general vicinity, but even if we do break out or break down, I believe that there will be plenty of areas to cause a lot of noise going forward. In fact, it may be next year before we can get a longer-term trade going.