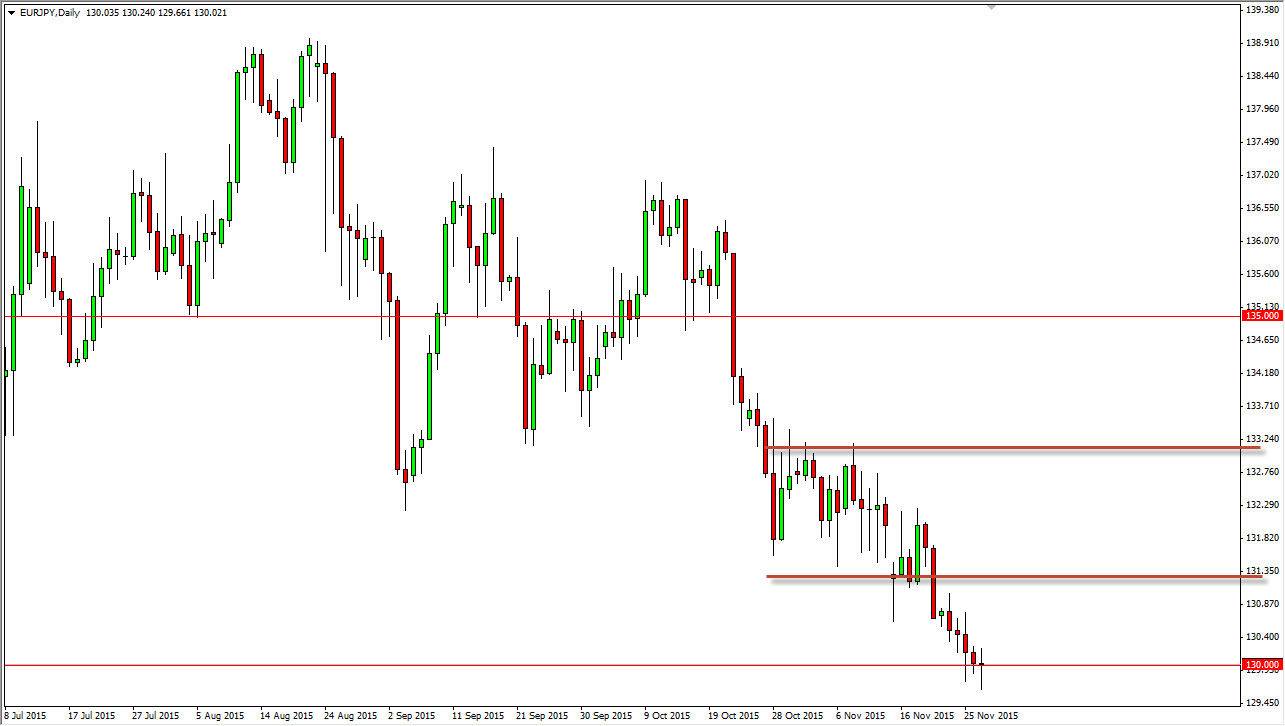

The EUR/JPY pair broke down during the day on Friday, slicing below the 130 handle. By doing so, the market turned back around to form a bit of a hammer, and that of course means that we could very well bounce from here. However, I do not look at any bounce at this point in time as a buying opportunity, because quite frankly the bearish pressure on the Euro in general is far too strong to be messed about with. I think that the European Central Bank could very well add more stimulus, and that of course will continue to work against the value the Euro overall.

The 130 level below of course is supportive, because it is a large, round, psychologically significant number. A bounce from here could be an opportunity for the market to try to find selling pressure near the 131 handle, or even as high as the 133 level. Any resistive candle is an opportunity to start selling, and I will use them as such. On the other hand, if we break down below the bottom of the hammer from the Friday session, we could very easily find this market going much lower, probably heading to the 128 handle first.

Bank of Japan

The Bank of Japan continues to be very soft when it comes to monetary policy, so having said that this pair is a bit of an anomaly when it comes to the Euro, but ultimately I think that this market continues to focus on the European Union, and not so much the Bank of Japan. I think given enough time we will break down but we may need to build up enough momentum to finally break below the large round number of 130. That’s quite common, and as a result the move doesn’t look out of whack as far as I can see.