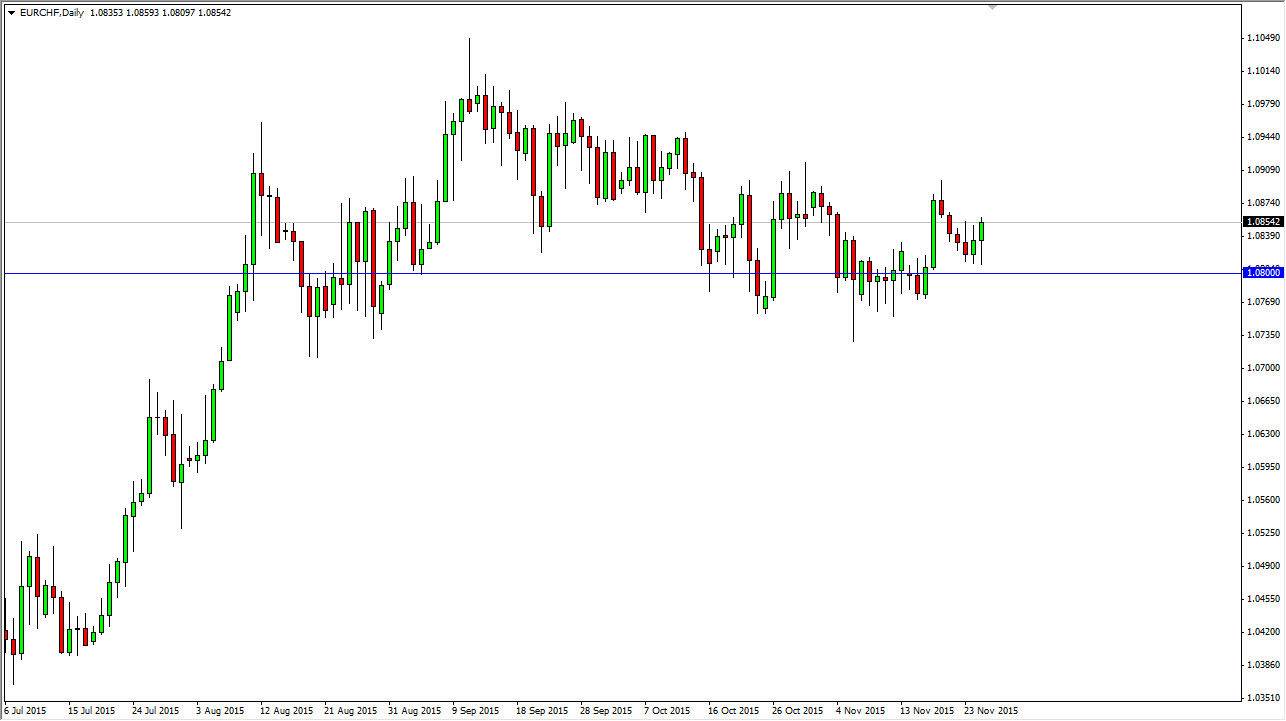

The EUR/CHF pair fell initially during the day on Wednesday but found enough support near the 1.08 level again to turn things around and form a hammer. This is in stark contrast to how the Euro has acted against other currencies around the world, as it lost value in most places. I believe that this market is still being manipulated by the Swiss National Bank, mainly because of the obvious support level somewhere near the 1.0750 handle. On top of that, recently the Swiss National Bank released financial statements showing that they had been picking up Euros, so needless to say I think the obvious support in a market that finds itself favoring the Euro suggests meddling at this point.

Longer-term Uptrend?

I think that ultimately we could get a longer-term uptrend, but the Euro needs to find support somewhere else. In a roundabout way, this market needs to see Euro strength in other pairs in order to take off to the upside. In the meantime it somewhat of a “holding pattern”, but I believe that the Swiss National Bank will continue to provide short-term buying opportunities just below. So at this point in time I’m willing to buy pullbacks for short-term gains.

I do believe that ultimately this pair will break out to the upside, but you are going to be very patient if you are waiting to see a longer-term move. In fact, we could be looking at a very consolidative and range bound market for months on end like we saw for several years previously. This is an artificially inflated market, and as that is the case I think that you do have to be careful that perhaps Swiss National Bank could step away, but at the end of the day as long as you place intelligent stops you don’t necessarily have to be overly concerned. I am bullish, but only for small gains from time to time.