By: DailyForex.com

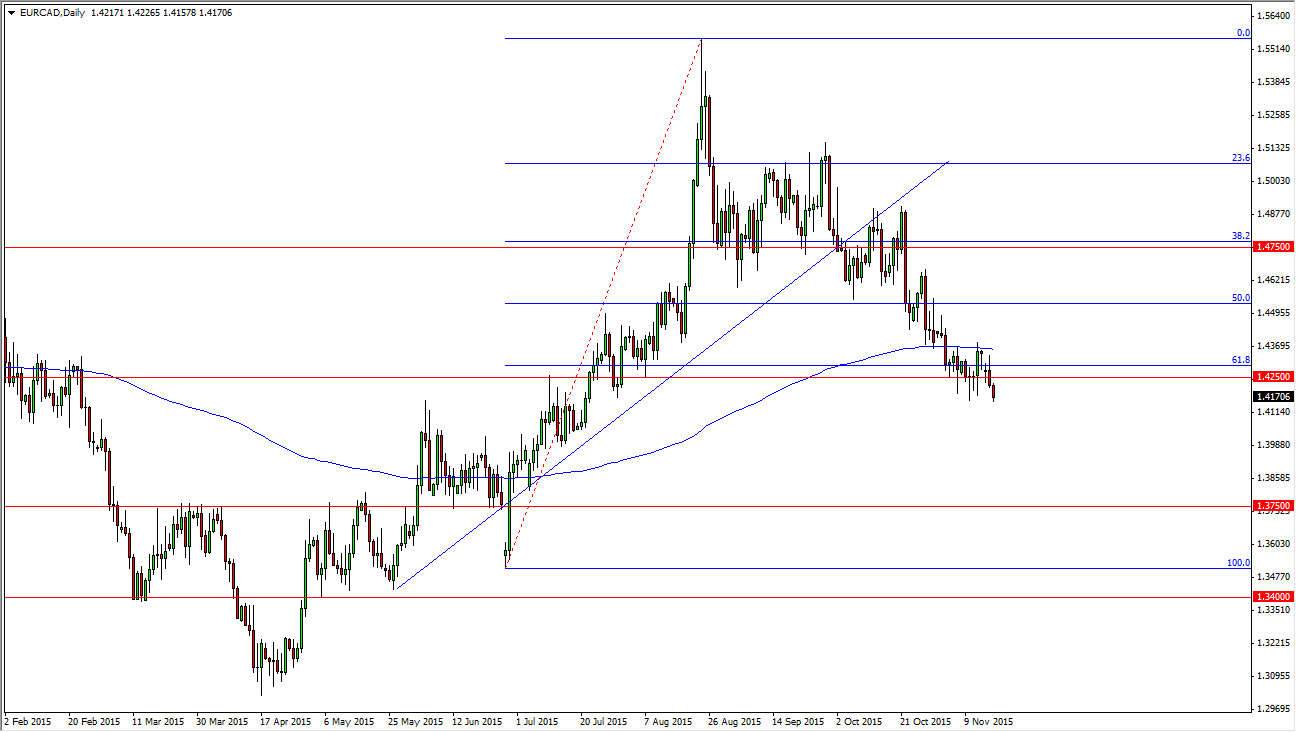

The EUR/CAD pair fell again during the session on Tuesday as we continue to show weakness. The 61.8% Fibonacci retracement level has been broken, and I now feel that it’s only a matter of time before we continue to break much lower. This of course is a bit counterintuitive as the oil markets are falling apart, but quite frankly I feel this has more to do with the Euro than anything else. The Canadian dollar is a commodity currency, but at this point in time it’s a North American currency, and that’s probably reason enough to own it over the Euro.

Because of this, I believe that this market will continue to go lower, and a move below the 1.4150 level is reason enough to start shorting again as far as I can see. Quite frankly, I look at any rally at this point time as a potential selling opportunity as this market simply looks like it’s ready to fall apart.

200 Day Exponential moving Average

Keep in mind that the 200 day exponential moving average is a fairly widely used indicator by longer-term traders, and the fact that we have broken below that level again tells me that more than likely we are going to see longer-term traders start pressing to the downside as well. With that being the case, I feel that the next move will be to the 1.3750 level below, which of course was supportive during the months of May and June, but also was resistive earlier in the year. Market memory by itself dictates that the market will pay attention to this area.

However, my experiences pulled me that most of the time when you get a break below the 61.8 Fibonacci retracement level, you will eventually hit the 100% Fibonacci retracement level. As you can see, that is closer to the 1.35 level, which of course is a large, round, psychologically significant number. Again, on a break below the 1.4150 level, I’m selling.