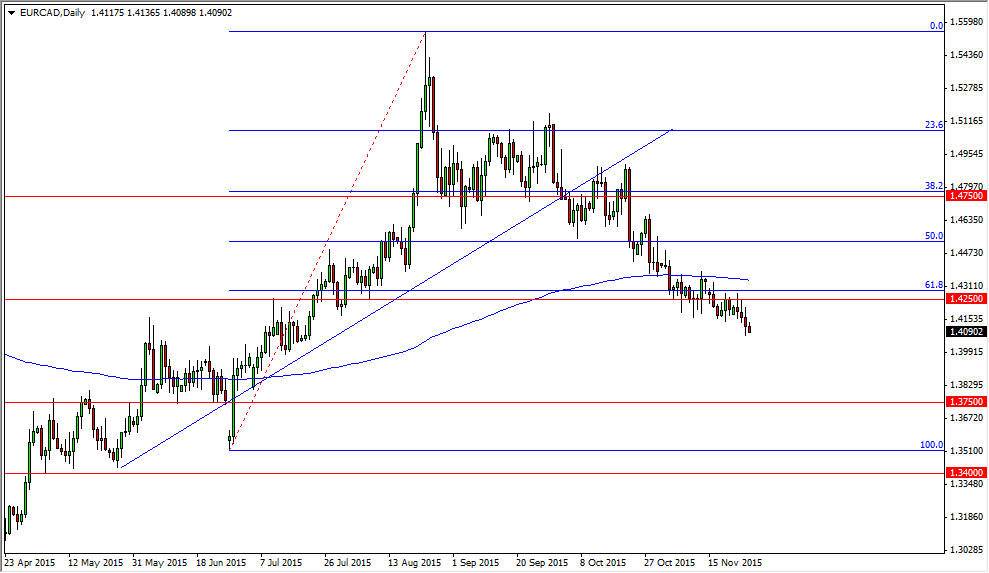

This is been one of my favorite trades for some time now, shorting the EUR/CAD pair. Initially tried to rally during the day on Thursday, but then turned back around to form a somewhat negative candle. Because of this, I continue to stay short of this market and I believe that we are going to drift down to at least the 1.3750 level as I see that is the next support level of any significance.

As you can see on the chart, and if you have been reading my analysis lately, you know that breaking down below the trend line of course was the first shot across the bow as it were for the Euro in this market, and then the impulsive red candle after we tested the bottom of the uptrend line that signaled that we were in fact going to continue going lower. Beyond that, we reached down below the 200 exponential moving average, which is a longer-term trader’s type of moving average that is quite common to use. This indicator alone can for some people be the sole trend indicator.

Fibonacci

My experience has been that if you break below the 61.8% Fibonacci retracement level, you typically go all the way back to the 100% level. That has this market reaching towards the 1.35 level, and I believe that begins a significant amount of support all the way down to the 1.34 handle. With that being the case, I think it’s only matter time before we would bounce from there. I continue to think that this pair will fall, and that this is an indictment on the Euro more than anything else as the Canadian dollar quite frankly isn’t that strong. Oil prices don’t do anything to strengthen the Canadian dollar, and therefore I think this is just simply the market reflecting on how it feels about the European Union at the moment. I think this pair continues offer profits to the downside.