By: DailyForex.com

AUD/USD Signal Update

Yesterday’s signals expired without being triggered.

Today’s AUD/USD Signals

Risk 0.75%

Trades must be entered between 8am New York time and 5pm Tokyo time today only.

Long Trade 1

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7072.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Long Trade 2

* Go long following a bullish price action reversal on the H1 time frame immediately upon the next touch of 0.7005.

* Put the stop loss 1 pip below the local swing low.

* Move the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 1

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7163.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

Short Trade 2

* Go short following a bearish price action reversal on the H1 time frame immediately upon the next touch of 0.7218.

* Place the stop loss 1 pip above the local swing high.

* Adjust the stop loss to break even once the trade is 20 pips in profit.

* Take off 50% of the position as profit when the trade is 20 pips in profit and leave the remainder of the position to ride.

AUD/USD Analysis

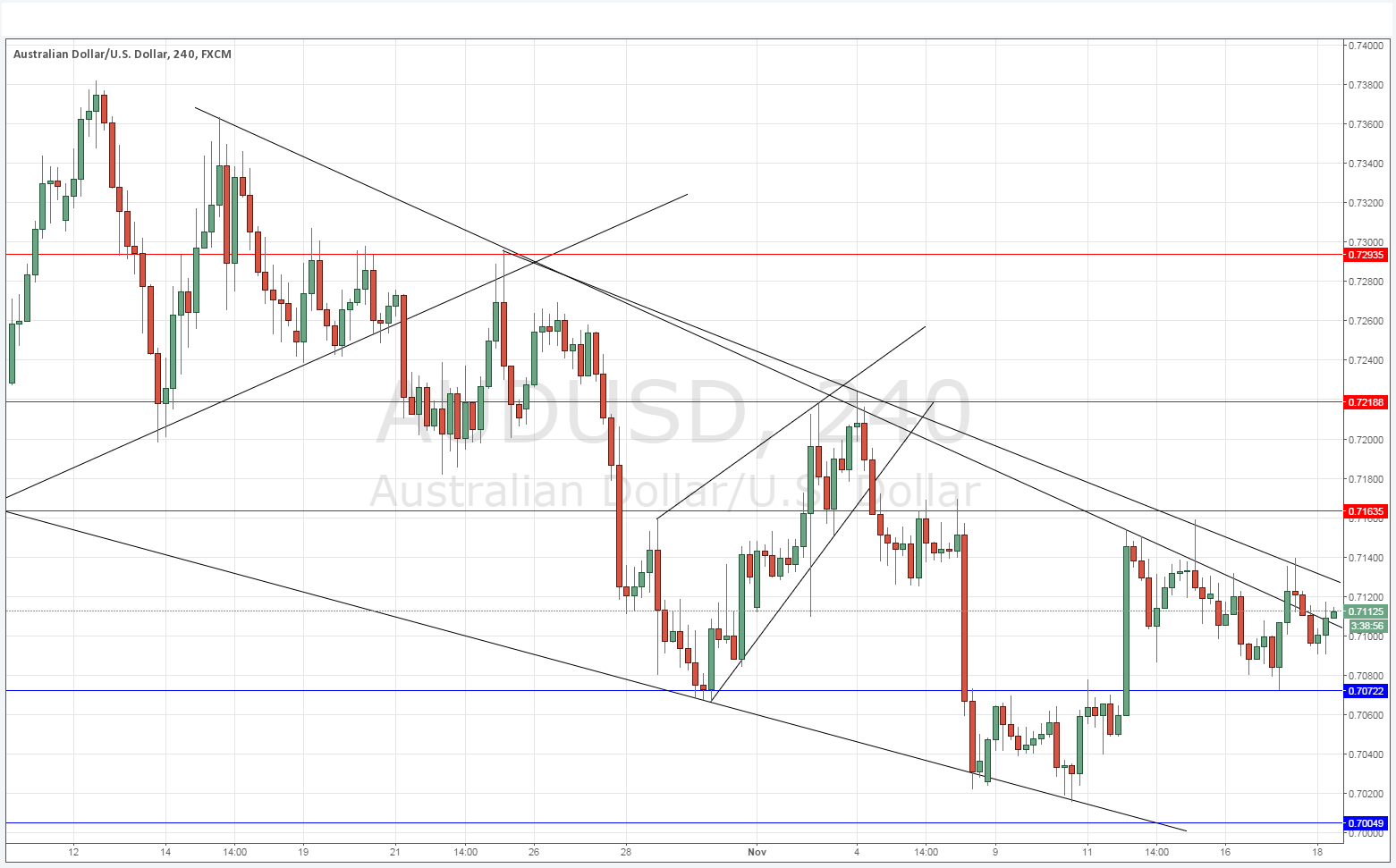

We seem to be reaching an interesting technical moment, with the long-term bearish upper channel trend line breaking to the upside. Before getting too excited about that, it is worth noting that things are actually more ambiguous, as an almost month-long bearish trend line can easily be drawn a little

higher, as shown in the chart below. I’d want to see the price clear this before declaring a good possibility of an intermediate trend change, but it looks like an interesting possibility that might occur after a possible USD-negative FOMC release tonight, or at least a release that the market responds negatively to.

There is nothing due today regarding the AUD. Concerning the USD, there will be a release of Building Permits data at 1:30pm London time, followed by the FOMC Meeting Minutes at 7pm.