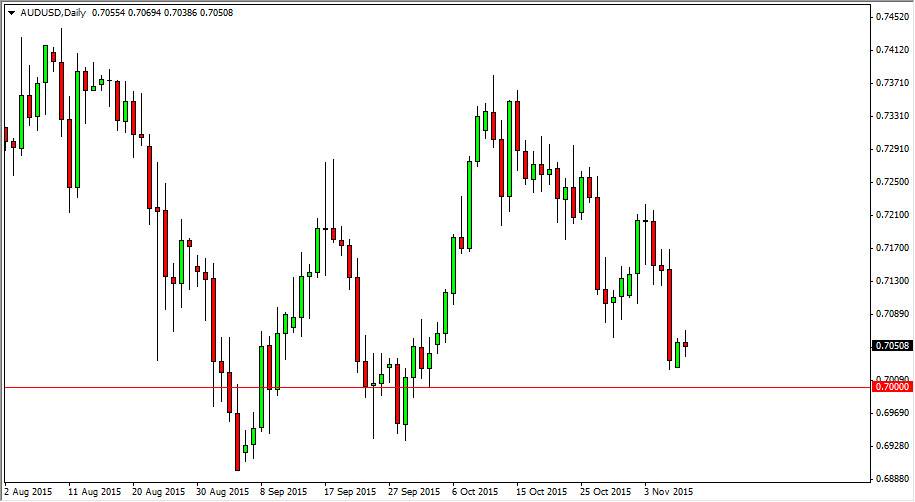

The AUD/USD pair went back and forth during the course of the session on Monday, as we continue to show quite a bit of volatility in a market that will certainly be one worth watching. After all, the Australian dollar is highly sensitive to commodities, with special attention being paid to the gold markets. The US dollar of course is the other side of the equation, and as a result this is quite often thought of as a proxy for the gold markets as gold is priced in US dollars obviously. However, you also have to keep in mind that the Federal Reserve may have to raise interest rates fairly soon, while Australia is far from doing so. Yes, the Australian interest rate is higher than the American industry, but at the end of the day when the industry differential tightens, it does favor the lower yielding currency.

Selling rallies

I believe that this is a market that you can sell rallies in, as there is more than enough downward pressure above. I believe that the jobs number last week signifies that the Federal Reserve will have to start raising interest rates fairly soon, and that of course will increase the value the US dollar in general. It will simultaneously decrease the value of gold as well, and that of course works against the value of the Australian dollar. It is a bit of a feedback loop going forward.

Rallies at this point in time will struggle and I would not be interested at all in buying this market until we got well above the 0.72 level, which I see as significant bearish pressure. If we broke down below the 0.70 level, I think that this market drops to the 0.68 handle, and then eventually the 0.65 level. At this point in time though, I highly doubt that any rally will reduce enough momentum to continue the move higher, so therefore I remain bearish.