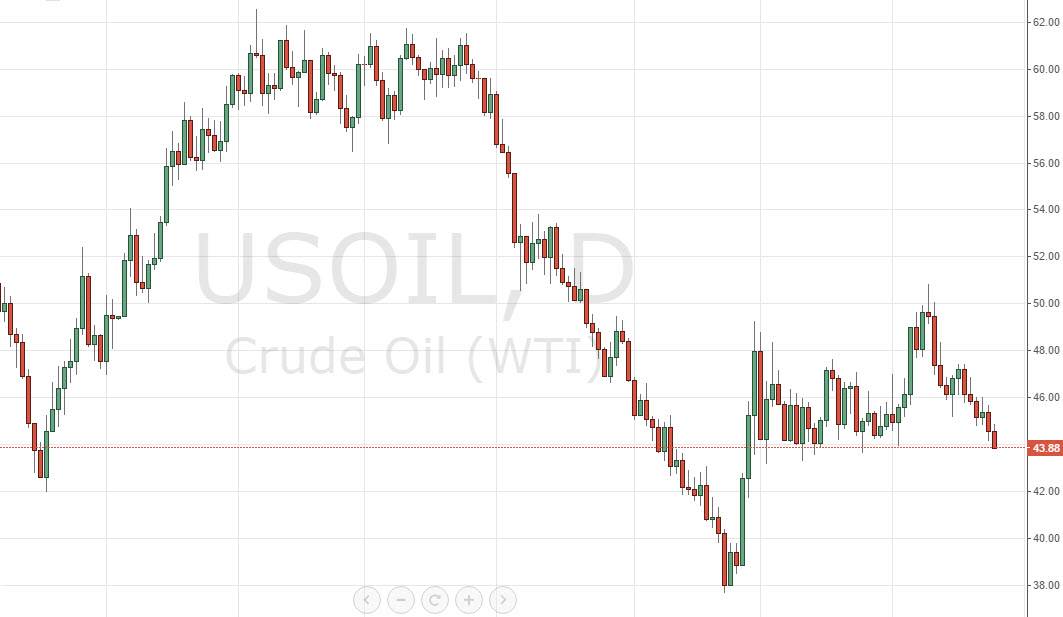

The WTI Crude Oil market initially tried to rally during the day on Monday, but turned back around and fell significantly. In fact, we even managed to break down below the $44 level, and as a result it seems as if the market is finally going to make a decision with this support level. If we break down below the $44 level significantly, the market should then reach towards the $40 level. We could even go lower than that, but at this point in time the one thing you have to keep in mind is that the market is closing towards the bottom of the range for the day, and that is a very negative sign as it should continue. At this point in time, the market has sold off rather drastically, and I have to admit that I am a bit surprised that we have not seen more of a fight buying the bullish traders out there.

Massive turning point

This is an area that could see this market turning one direction or the other, and quite frankly if we get a supportive candle, then I’m willing to start buying again. On the other hand though, if we break down as I suspect we might, this market will more than likely drop by $2 at a time. That could send this market lower, and perhaps even to a lower low. Keep an eye on the US dollar honestly, as this commodity is priced in that currency, and as it goes higher it typically will put more pressure on the oil markets.

If we did bounce from here, I think the market will more than likely reach towards the $46 level, and then possibly the $48 level. If we can get above the $50 level, it is likely that we will have a trend change, and quite frankly I had thought that was going to happen. It is still possible obviously, but time is most certainly running out for the buyers.