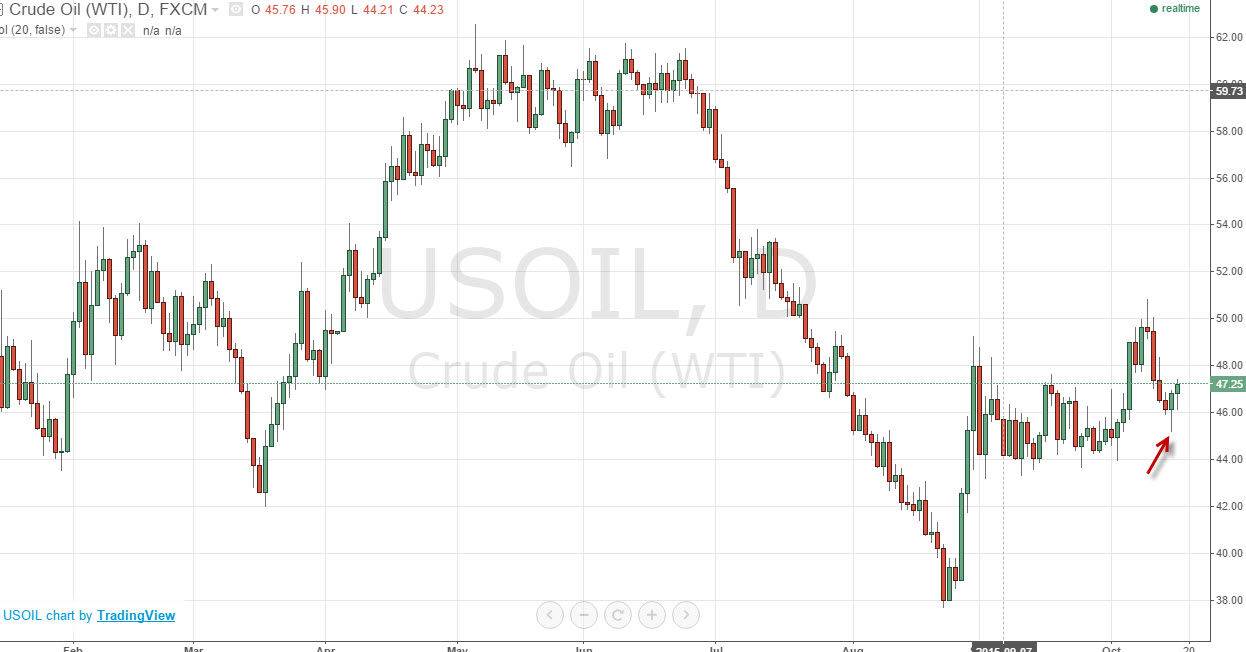

The WTI Crude Oil market initially fell during the course of the session on Friday, but found enough support near the $46 level to turn things back around and form a hammer. The hammer of course is a bullish sign, and as a result I feel that the buyers are starting to come back into this marketplace. On top of that, the Thursday candle was also a hammer at the $46 level, and then shows that we are trying to fight our way back to the upside. After all, the market recently had an impulsive move higher from the $38 level, and then went sideways. Normally when this happens, it shows that the market is essentially “comfortable” with the move higher. Now that we have seen so much in the way of support at the $44 level, this market should continue to go much higher.

US Dollar

The US dollar fell apart recently, and that of course helps the oil market as far as value is concerned. The fact that we have seen so much support in this general vicinity tells me that the market is attracting more and more buyers. If we can break above the top of the candle, I feel that the market should then go to the $50 level. Once we break above the $51 level, I feel at that point in time the market continues to go much higher and it is essentially a trend change, something that I expect to see eventually.

Every time this market pulls back, that should offer value that you can take advantage of. I am a buyer of short-term opportunities at this point, but once we get above that aforementioned $51 level, I feel that the market drives all the way to at least $58 at that point. Keep in mind that the oil markets have been sold off rather viciously, so some of the rallies could be sudden and violent. I have no interest in selling this market at all until we get well below the $44 level.